Market Update: August 2020

Here’s a snapshot summary of the significant real estate milestones for Toronto in August 2020 as we finish the 6th month of the coronavirus pandemic.

August sales were 39.7% higher than last year (10,775) – a record for August on TRREB

The ratio of sales-to-listings declined slightly to 64.7% in August – still in busy seller market territory

The August average sale price came in at $951,404– 20.1% above August 2019 and the highest EVER average sale price for the GTA

The GTA real estate market overall averaged 17 days-on-market

Detached home sales in August 2020 with a purchase price over $2,000,000 were up a big 152% (377 houses) while condo apartment sales over $2M were up by a busy 260% (18 suites) compared to July 2019

The CONDO share of the market was steady at 28.8% during the month

Downtown condo active listing numbers were UP by a big 162% in C01 and by 242% in C08 from last year at this time

August condo sales were flat in C01 and increased in C08 by 22.3% compared to 2019

The downtown condo days-on-market average was 19 days in C01 and 20 days in C08

The ratio of sales-to-listings for condos downtown continued to show significant declines in C01 (from 62% in 2019 to 23.8%) and in C08 (from 70% in 2019 to 24.9%)

Even when influenced by the lower demand and higher inventories due to the virus effect, condo values still beat the averages seen in August 2019 and appreciation gains over the last 12 months stayed strong

August saw detached homes in the 905 appreciate by an average 18.5% while sales were up over 47%. 905 condo apartment sales were up 14.5% while average sale prices rose by 12.9%

It looks like pent-up buyer demand and very low interest rates will continue to spur the market throughout the fall season as long as we keep a handle on COVID case numbers

*SOURCE: Thomas Cook - RE/Max Hallmark Realty Ltd., Brokerage

Greater Toronto Real Estate Market Report: RE/Max Canada

Detached housing values have shown remarkable resilience in the first half of 2020, with 95 per cent of Greater Toronto real estate districts posting solid gains in average price, according to a report released today by RE/MAX of Ontario-Atlantic Canada.

The RE/MAX 2020 Hot Pocket Communities Report examined trends and developments in 65 Toronto Regional Real Estate Board (TRREB) districts, finding that a steep decline in the number of homes listed for sale during Ontario’s State of Emergency contributed to a notable uptick in single-detached housing values. Active listings across Greater Toronto real estate markets hovered at 14,000 in June, the lowest level for the month since 2016 when active listings bottomed-out at 12,327. Average price was up in 95% of areas between January and June 2020, compared to the same period in 2019. Double-digit increases were reported in 60% of 416 districts and in 50% of 905 districts.

“Strong demand characterized much of the first quarter of 2020, setting the stage for a record-breaking spring market in the Greater Toronto Area – and then came Covid-19,” says Christopher Alexander, Executive Vice President and Regional Director, RE/MAX of Ontario-Atlantic Canada. “In past downturns, a drop in unit sales has usually been followed by a significant upswing in the number of homes listed for sale. That didn’t happen in this case as buyers and sellers paused in April, then cautiously resumed home-buying activity as COVID-19 cases dropped and local economies re-opened. With the easing of restrictions and the province moving into the third, and perhaps final phase, we anticipate that the housing market will likely accelerate.”

Location will be top-of-mind for most homebuyers, as illustrated by this year’s top five markets (two tied in second place). Of the 65 Greater Toronto real estate districts examined in the report, RE/MAX found that the strongest gains in average price occurred in areas in close proximity to Toronto’s central core. Leading in terms of percentage increase in the average price of a detached home in the first half of 2020 is Yonge-St. Clair, Annex, Casa Loma and Wychwood (C02), where values climbed 25.7% to $2,918,968. Move-up buyers were particularly active in this area, with a shortage of homes listed for sale, particularly in the Annex. In June, there were 28 active listings, and 17 average days on market, and the sale-to-list price ratio was 98%.

With an increase of 18.4% in average price, two markets straddling the lakeshore in the east and west ends of the city ranked second in terms of price appreciation. Swansea, Roncesvalles, South Parkdale and High Park (W01) saw detached housing values climb to $2,050,596, while Oakridge, Birchcliffe-Cliffside (E06) topped $1 million, settling in at $1,095,287. Young families were a major driver in both areas, with affordability and proximity to the Beach community drawing buyers to Oakridge, Birchcliffe-Cliffside, and close proximity to the downtown core and west-end shoreline attracting purchasers to High Park, Swansea, Roncesvalles, and South Parkdale.

While C03 is home to Forest Hill South and some of the most expensive real estate in the city, the area is also comprised of affordably priced hot pockets such as Oakwood-Vaughan and Humewood. The average price of a detached home in C03 is up 17.7% to $2,371,546, although a small bungalow in the aforementioned neighbourhoods can be purchased for just over $1 million. The same holds true for W08, home to the tony Kingsway South, but also offers up detached homes starting at just under $1 million in neighbourhoods such The West Mall. Average price in W08 was up 17% in the first half of the year, compared to the same period one year ago, rising to $1,693,382. Alderwood, Long Branch, New Toronto and Mimico in W06 have also been on an upward trajectory in recent, with the average price of a detached home rising 16.2% to $1,202,176.

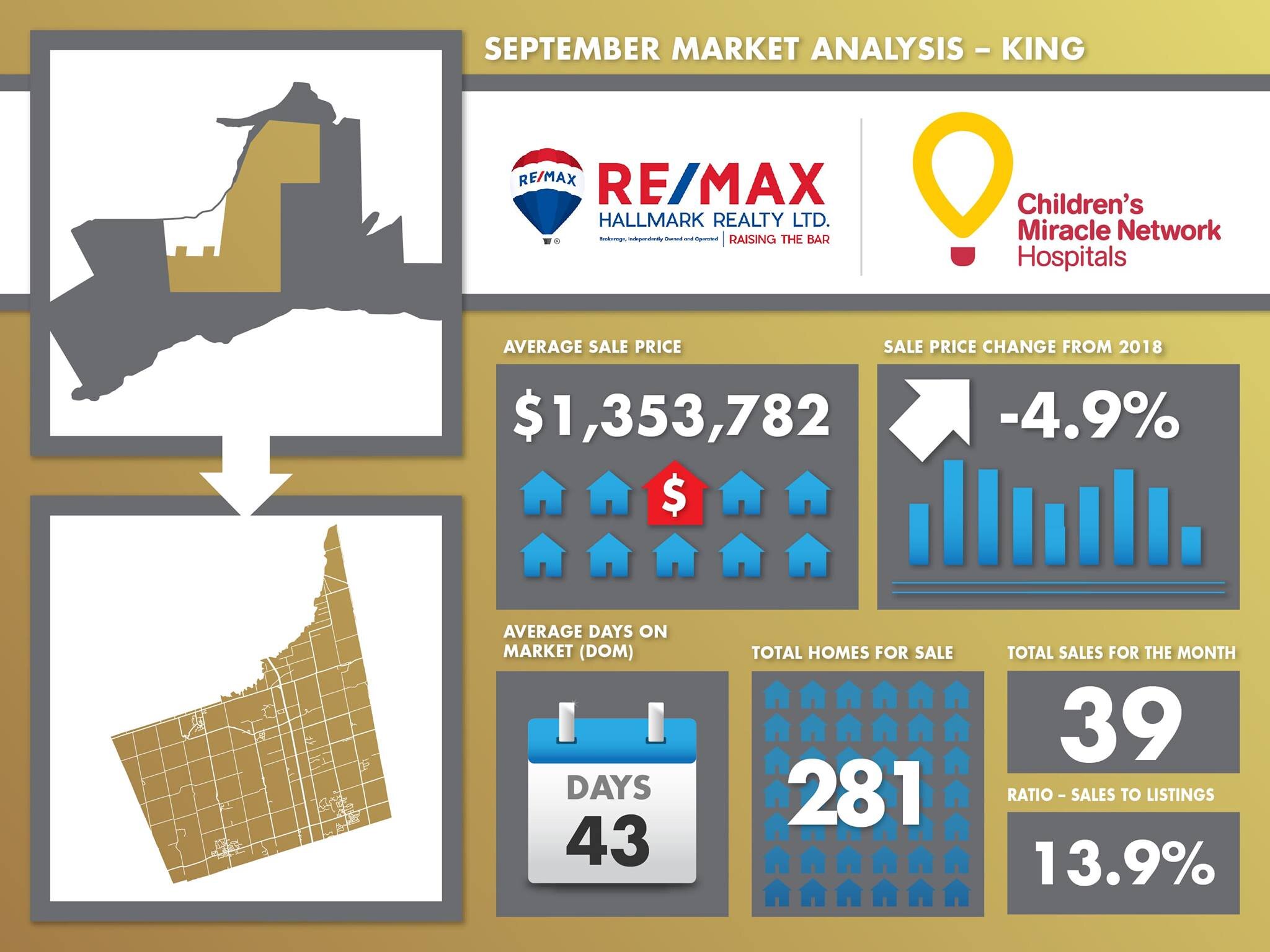

While sales of detached homes were down overall, RE/MAX found several suburban/rural districts that bucked the trend, showing signs of growth. Most were located in more suburban/rural areas of the Greater Toronto Area, where the dollar stretched farther and listings were plentiful. Leading in terms of percentage increase in detached housing sales was the King area in York Region where 161 detached properties changed hands, up from 117 one year earlier, representing a 37.6% upswing in volume. Just under 200 active listings were available for sale in June, average days on the market hovered at 44, while the sales-to-list price ratio was 93%.

Bridle Path, Sunnybrook, York Mills, St. Andrew, and Windfields (C12), the only district in the 416 to post an uptick in sales, claimed second place for sales. The area, the most expensive in the GTA, experienced a 20.6% increase in sales between January and June 2020, with the number of detached homes sold rising to 76, up from 63 during the same period in 2019. Days on market were 19, with a sales-to-list price ratio of 94%. Close to 100 homes were listed for sale in June.

Affordability was the common denominator in the third, fourth and fifth place finishes, all with an average price between $600,000 and $650,000. Simcoe County’s Innisfil posted strong gains, ranking third with a 14.4% increase bringing the number of sales in the area to 389, up from 340 in 2019. Days on market were 35, sales-to-list price ratio was 99%, and more than 220 active listings were available in June. Fourth place Oshawa, in Durham Region, also proved a hot spot for sales so far this year, with more than 1,053 single-detached homes sold in the first half of the year, a 10.8% increase over 2019. Detached homes are moving quickly, with average days on market at 16, the sales-to-list price ratio is 101%, and 200 active listing available for sale in June. Rounding out the top five was Georgina in York Region, with 373 detached homes sold in the first six months of the year, up 9.1% over the 342 sales reported during the same period last year.

“While the strength of the market is underscored by rebounding economic fundamentals, it’s clear that we are not out of the woods yet, given what’s happening around the world,” explains Alexander. “Having said that, the manner in which government has handled Covid-19 has been exemplary, and while there may have been some missteps along the way, we have all benefitted from leadership at all three levels. I’m confident that under their continued guidance and direction, we will be able to navigate any and all stormy waters ahead, and that bodes well for the economy and the housing market overall.”

*Source - https://blog.remax.ca/greater-toronto-real-estate-market-report-re-max-canada/?utm_campaign=OA%20PR%20Reports&utm_medium=email&_hsmi=91683689&_hsenc=p2ANqtz-8zlkpmsDVfj2SjVGv0fWqFkHIgCahlaq5H_921JQ_cjZVgoNdXJegZo_1Ap2H5EJIRcjHM9mXv_9geDwmiKvftJPqucQ&utm_content=91683689&utm_source=hs_email

RE/MAX Hallmark 2020 Scholarship

RE/MAX Hallmark is once again offering the Scholarship Program!

This program has been a tremendous success since starting in 2007. We have awarded over $175,000 for post-secondary education to eligible children of Clients and Administrative Staff.

This year the Scholarship Fund is $25,000 for the 2020 Fall Semester of post-secondary education. The funds are to be shared amongst present and past clients of RE/MAX Hallmark realtors that are selected. We encourage you to connect with your clients and promote this program as it will benefit them and yourself.

Please note, REALTORS children or family members are not eligible for the Scholarship Program. This program is designed to benefit your clients.

Deadline to accept applications for our 2020 Fall Scholarships is April 17th. Please contact us for the program’s complete criteria and application form.

If you require further information, or would like to obtain an application form, please contact Alicia at 416.494.7653 or via email at alicia@connexusgroup.ca. We would be happy to endorse your child in our Scholarship Program to help with their education

At RE/MAX Hallmark, we feel strongly about contributing to the minds of tomorrow and investing in the future of our children.

Best of luck,

Ravi, Justin, Ashley, Sabrina, Alicia and Angela

#theconnexusadvantage

The Time is Now: Planning for Growth in the GTA

TREB Market Year in Review and Outlook Report

This year's report, subtitled The Time is Now: Planning for Growth in the GTA, explores some of the most important market issues affecting our industry today. Published February 2020

“This is the fifth edition of our

Market Year in Review & Outlook Report,

a report that I am immensely proud to have

seen grow over the years into a must-read, not

only by those with an interest in the Greater Golden

Horseshoe (GGH) real estate market, but also by those

with a keen interest in seeking solutions to improve

the quality of life in this region.”

This years report Highlights the following Key Topics:

2020 Housing Forecasts (Page 13)

Rental Market Outlook (Page 17)

Commercial Market Outlook (Page 27)

Policy makers commentary from all major Municipality Mayors (Page 31)

Transportation proposed solutions for Population Growth (Page 41)

Click here for the 2020 Report

Click here for a mobile friendly, single column version of the Report

Click here for a user-friendly flip version of the Report

*Source Toronto Real Estate Board TREB February 2020

State of the Market Episode 3.7 | Review of REMAX 2020 Housing Outlooks and Ravi's Predictions

On the last episode of State of the Market for 2018, Ravi discusses the REMAX 2020 Outlook and discusses insight on his own predictions for this year…

*Facebook Live December 30th 2019

Ravi Singh was name one of the most Interesting People in Real Estate by Inman News in 2016. Award winning Realtor with ReMax Hallmark and team leader at The Connexus Group.

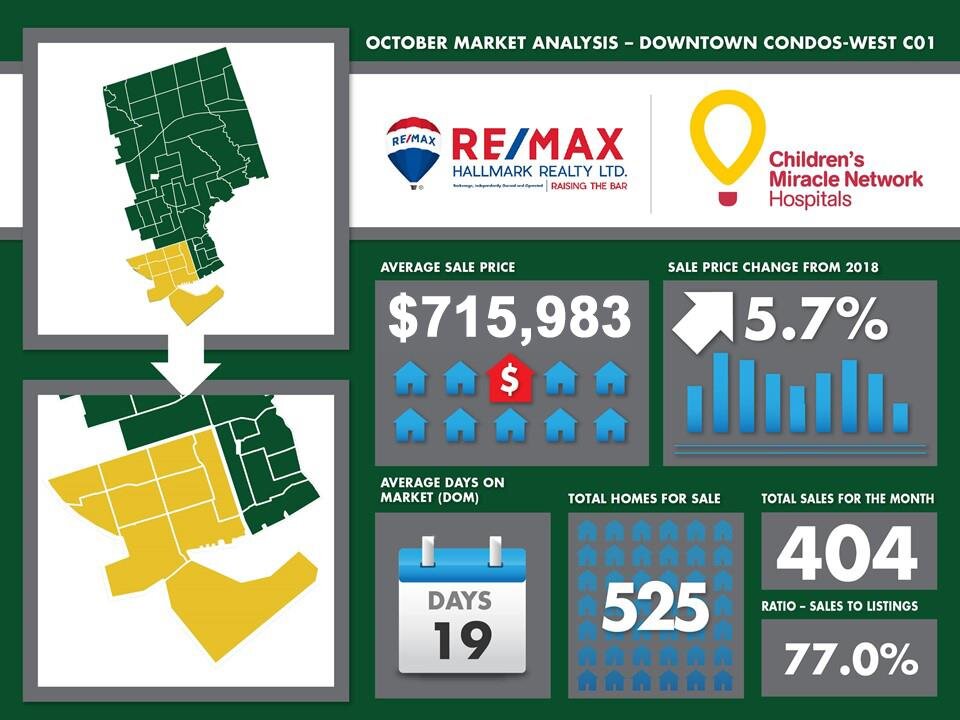

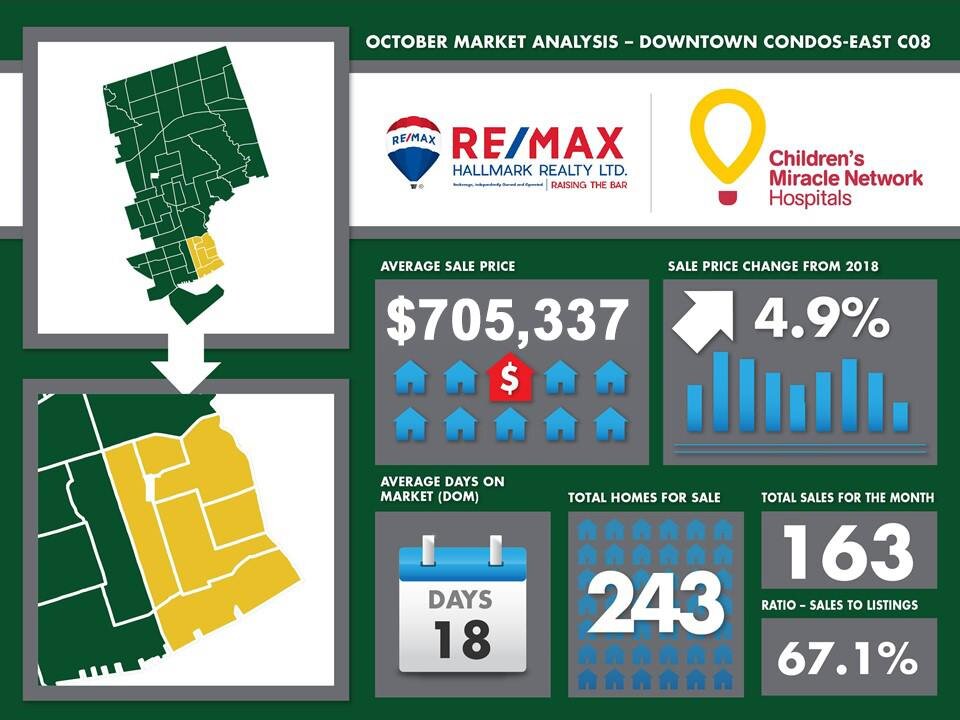

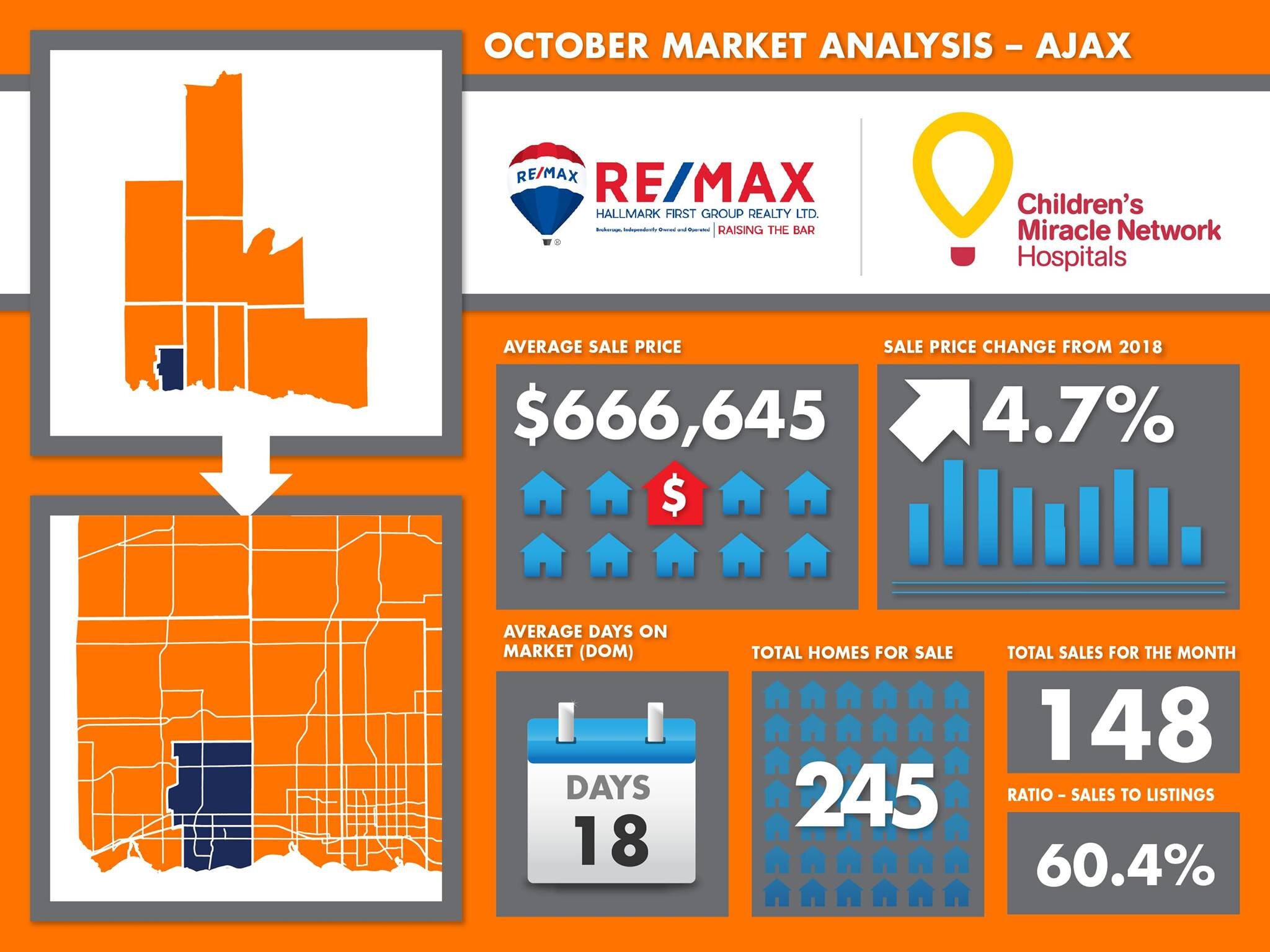

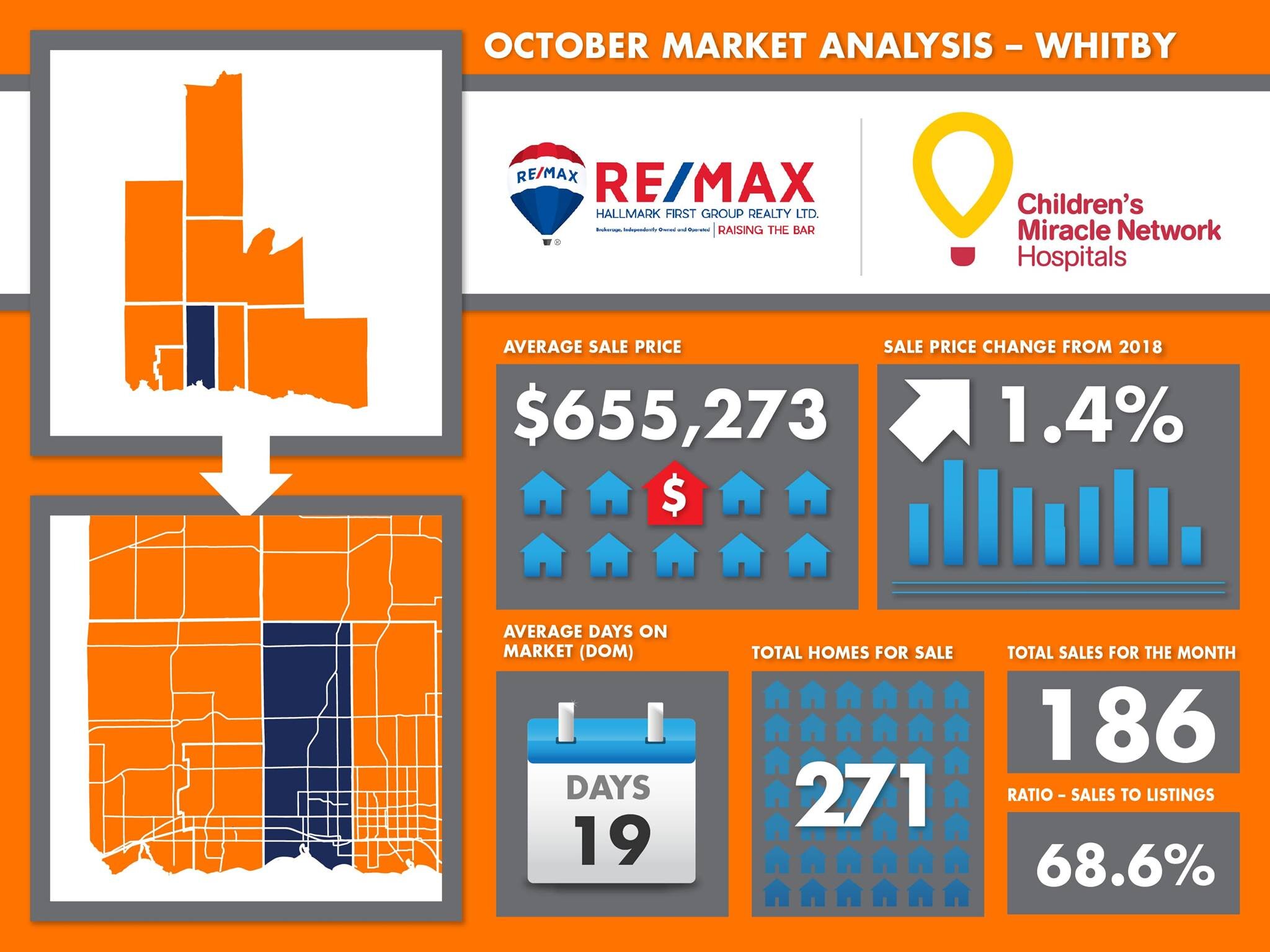

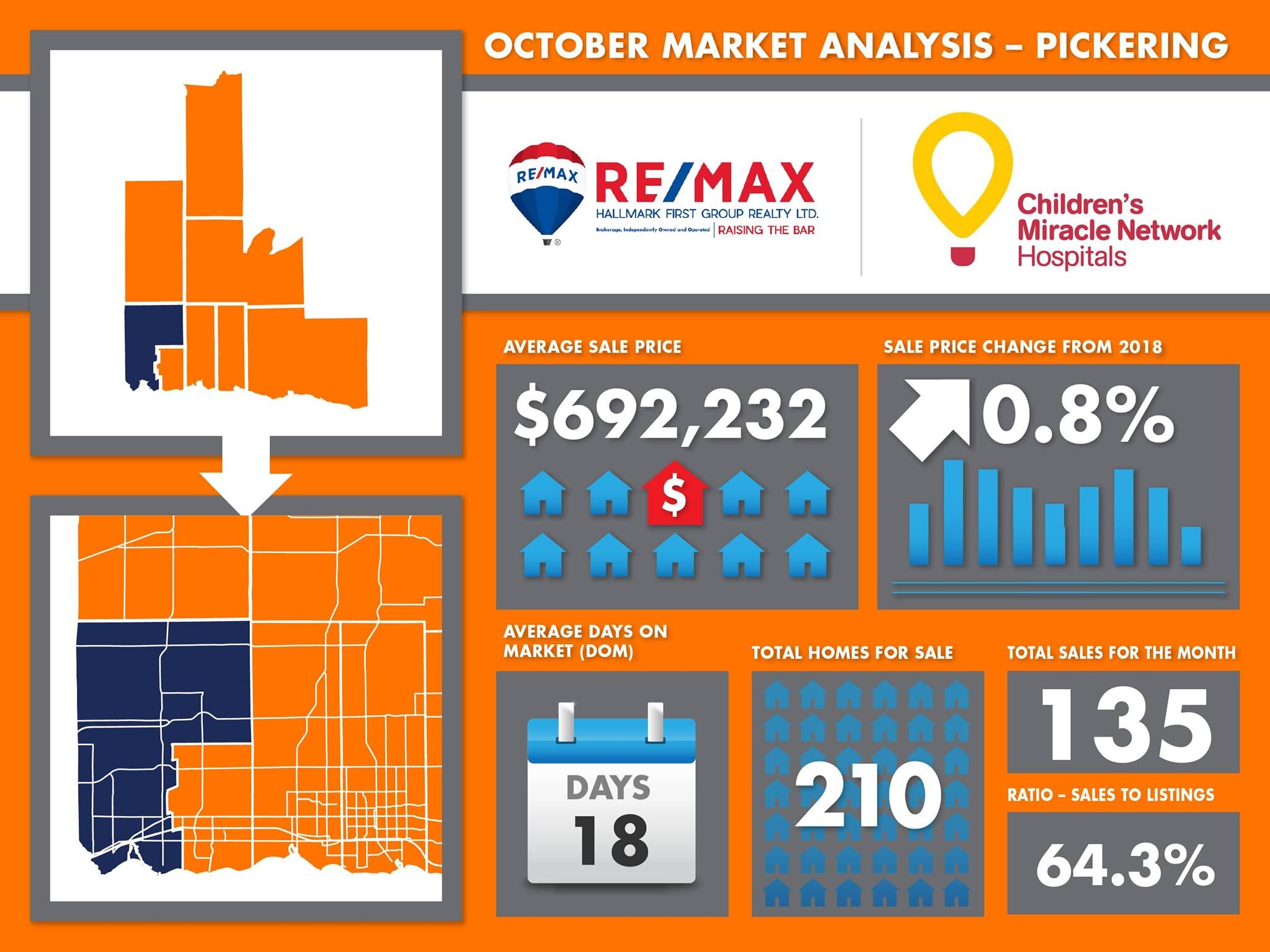

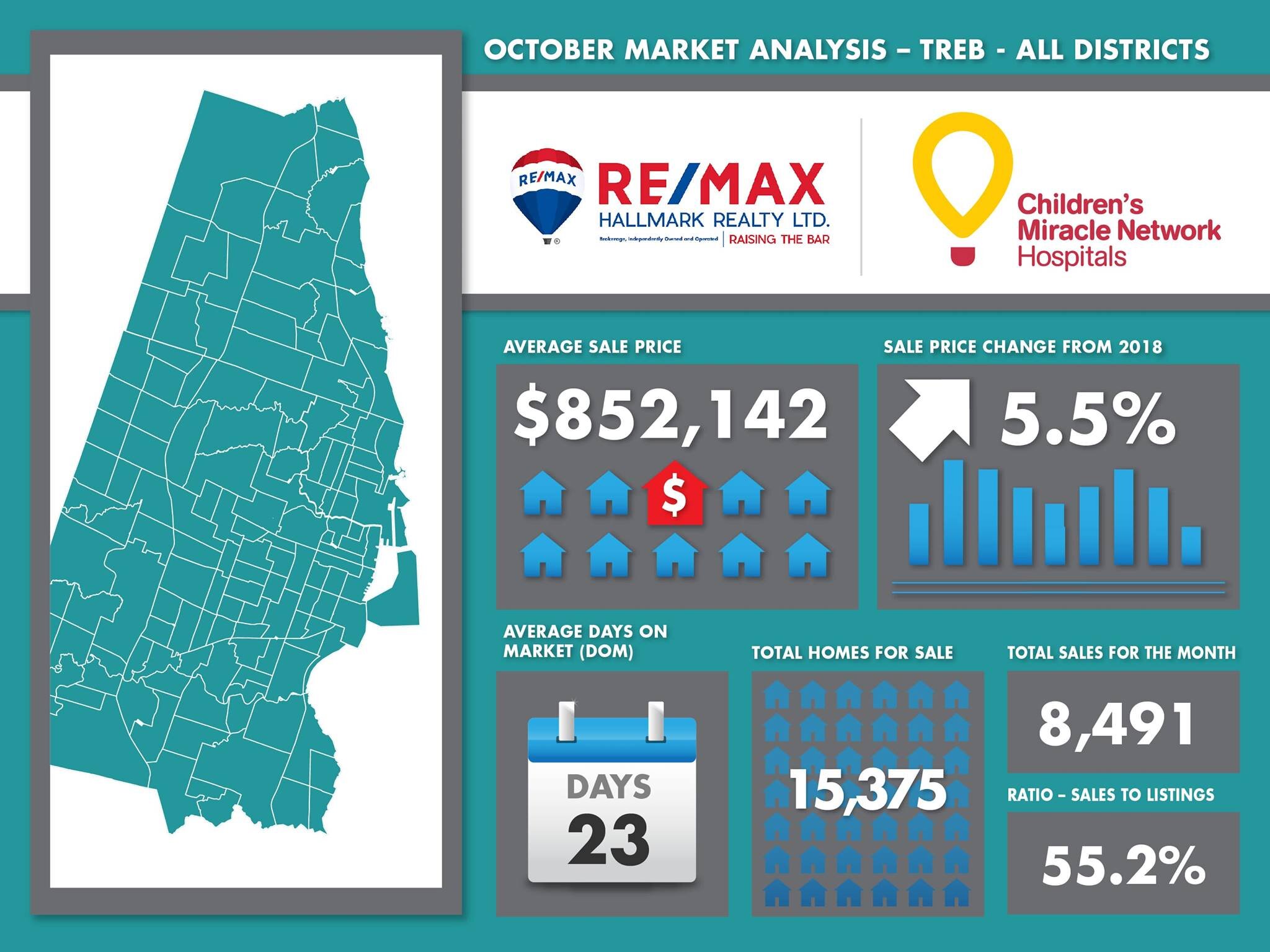

October Market Statistics

Here’s a snapshot summary of the significant real estate milestones for Toronto in October 2019… the highest average sale price so far in 2019!!

October sales up 13.8% compared to last year (8,491)

The ratio of sales-to-listings jumped up to 55.2% in October

The average sale price came in at $852,142– up a positive 5.5% compared to last year

Note that this overall market average # is the highest we’ve seen all year

The GTA real estate market overall averaged 23 days-on-market

Detached home sales in October 2019 with a purchase price over $2,000,000 were up 5.4% (213 houses) while condo apartment sales over $2M were up 108% (25 suites)

The CONDO share of the market was steady at 34% during the month

Downtown condo active listing numbers were down 3.1% in C01 and increased in C08 by 4.3% from last year at this time

October condo sales were up 2.5% in C01 and up in C08 by 14% compared to 2018

The downtown condo days-on-market average was 18-19 days – 4-5 days faster than the overall market

The ratio of sales-to-listings for condos downtown was somewhat matched in C01 (77%) and in C08 (67.1%) but both were still much higher than in the overall market (55.2%).

Building on this higher demand due to better affordability, condo appreciation in the two main downtown markets averaged 4.9% to 5.7% year-over-year… consistent with what we’ve been seeing all this year.

Sales numbers have now increased in many 905 neighbourhoods although appreciation percentages are lower across the board in the 905.

October is the mid-point of our fall market and we can typically expect sales numbers to slow as we go through November and close in on the Xmas holiday season.

*Source - Thomas Cook Remax Hallmark Realty Ltd., Brokerage

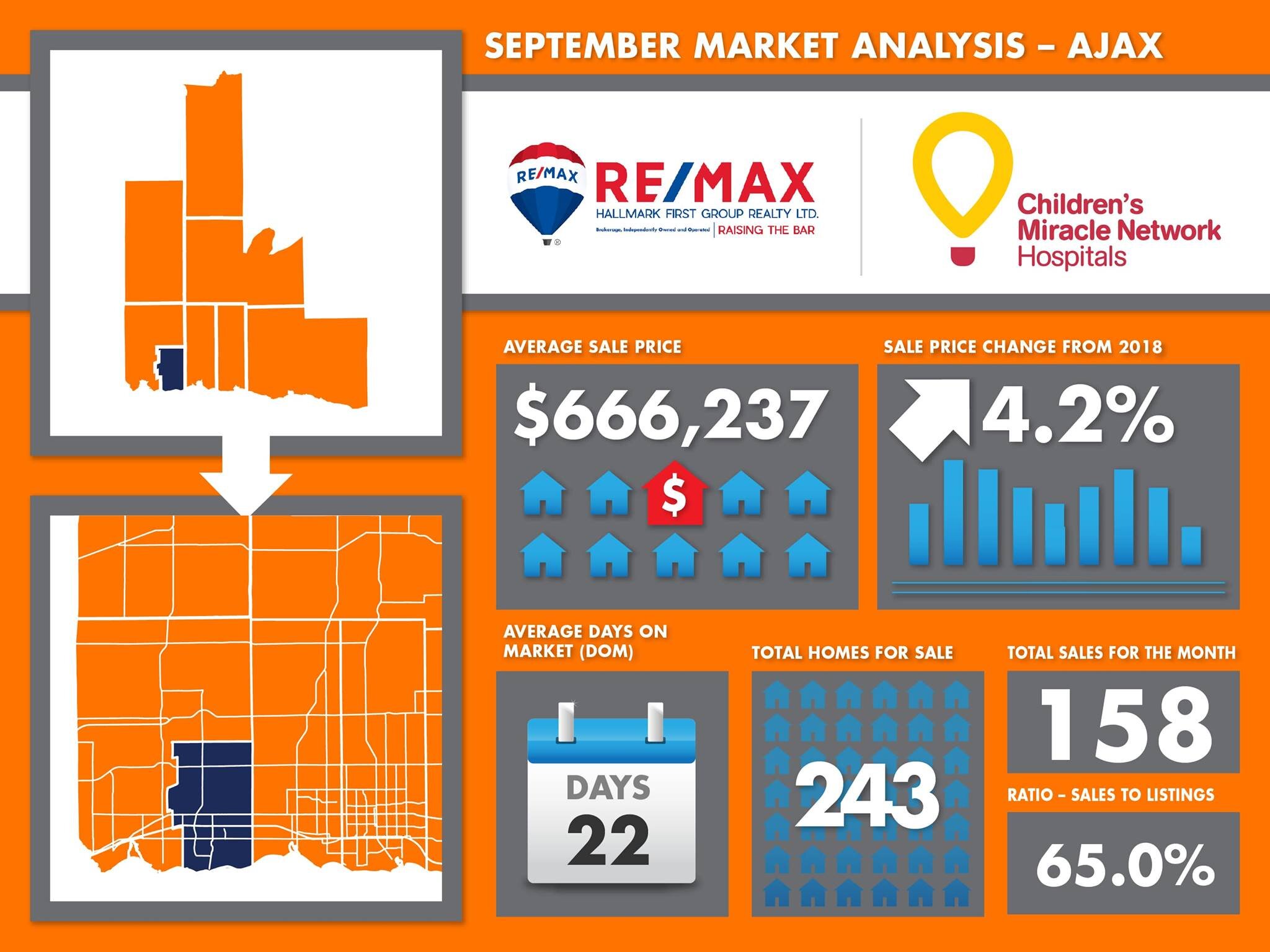

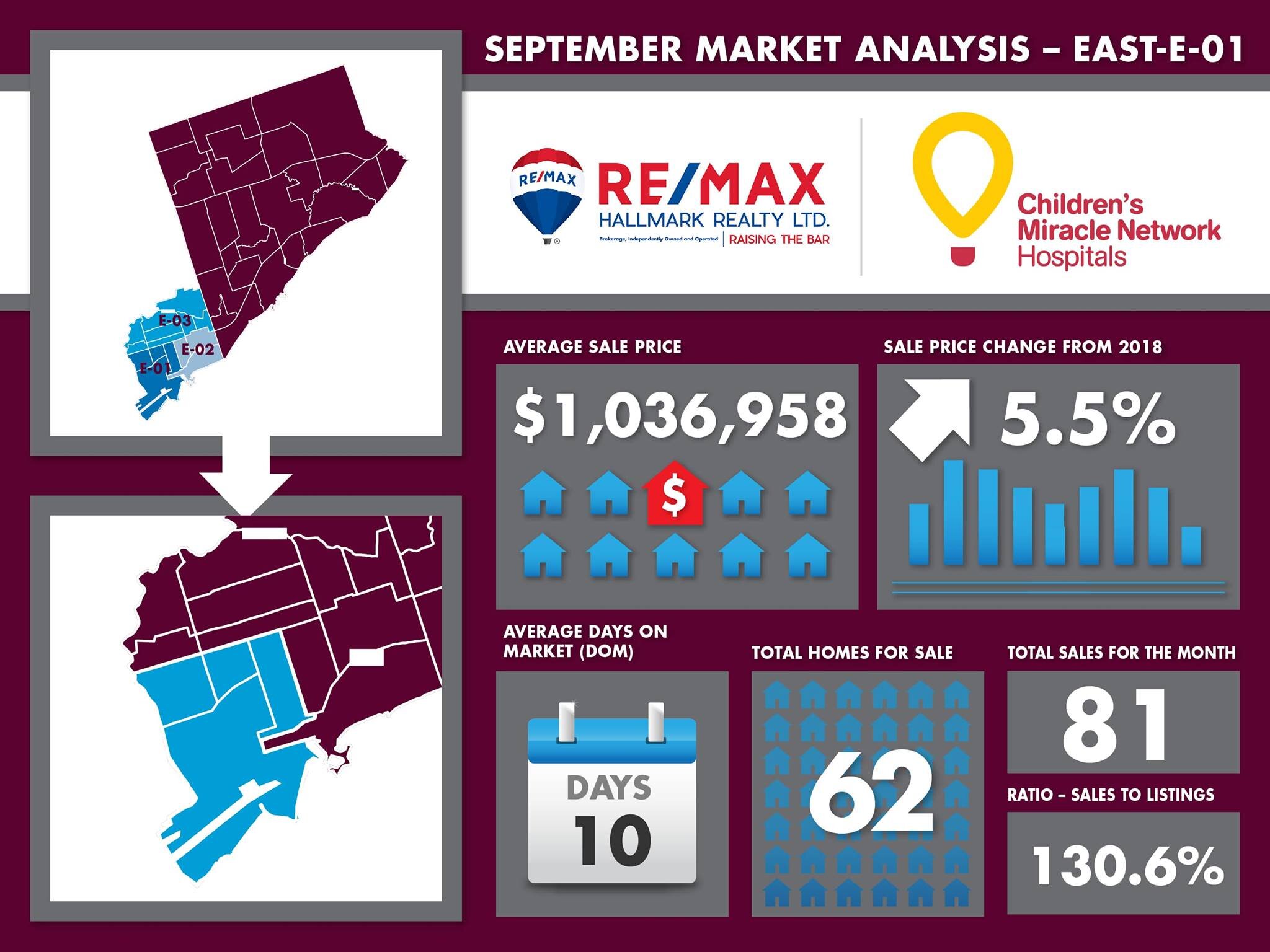

Septemer Market Statistics

Here’s a snapshot summary of the significant real estate milestones for Toronto in September 2019… the highest year-over-year appreciation number in 2019!!

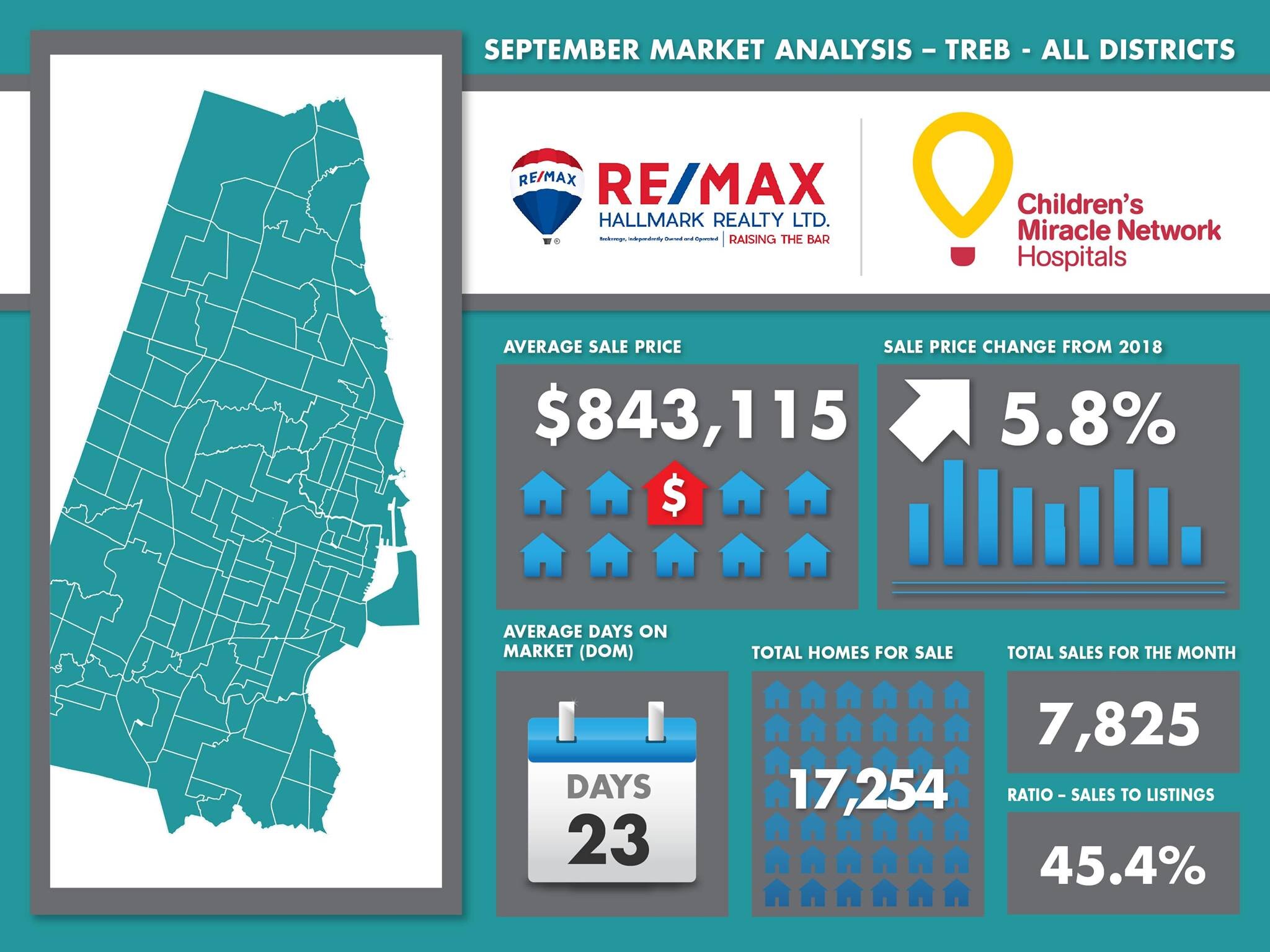

September sales up 22% compared to last year (7,825)

The ratio of sales-to-listings dropped very slightly to 45.4% in September

The average sale price came in at $843,115 – up a positive 5.8% compared to last year

Note that this overall market average is almost 9% higher than the average 2 years ago in September 2017

The GTA real estate market overall averaged the days-on-market at 23

Detached home sales in September 2019 with a purchase price over $2,000,000 were up 32% (218 houses) while condo apartment sales over $2M were up 14% (16 suites)

The CONDO share of the market was steady at 34% during the month

Downtown condo active listing numbers were up 8.6% in C01 and increased in C08 by 13% from last year at this time

September condo sales were down 7% in C01 and up in C08 by 19% compared to 2018

The downtown condo days-on-market average was 18-22 days – 1-5 days faster than the overall market

The ratio of sales-to-listings for condos downtown was somewhat matched in C01 (52.8%) and in C08 (68.3%) but both were still much higher than in the overall market (45.4%).

Building on this higher demand due to better affordability, condo appreciation in the two main downtown markets averaged 4.3% to 5.3% year-over-year… consistent with what we’ve been seeing all this year.

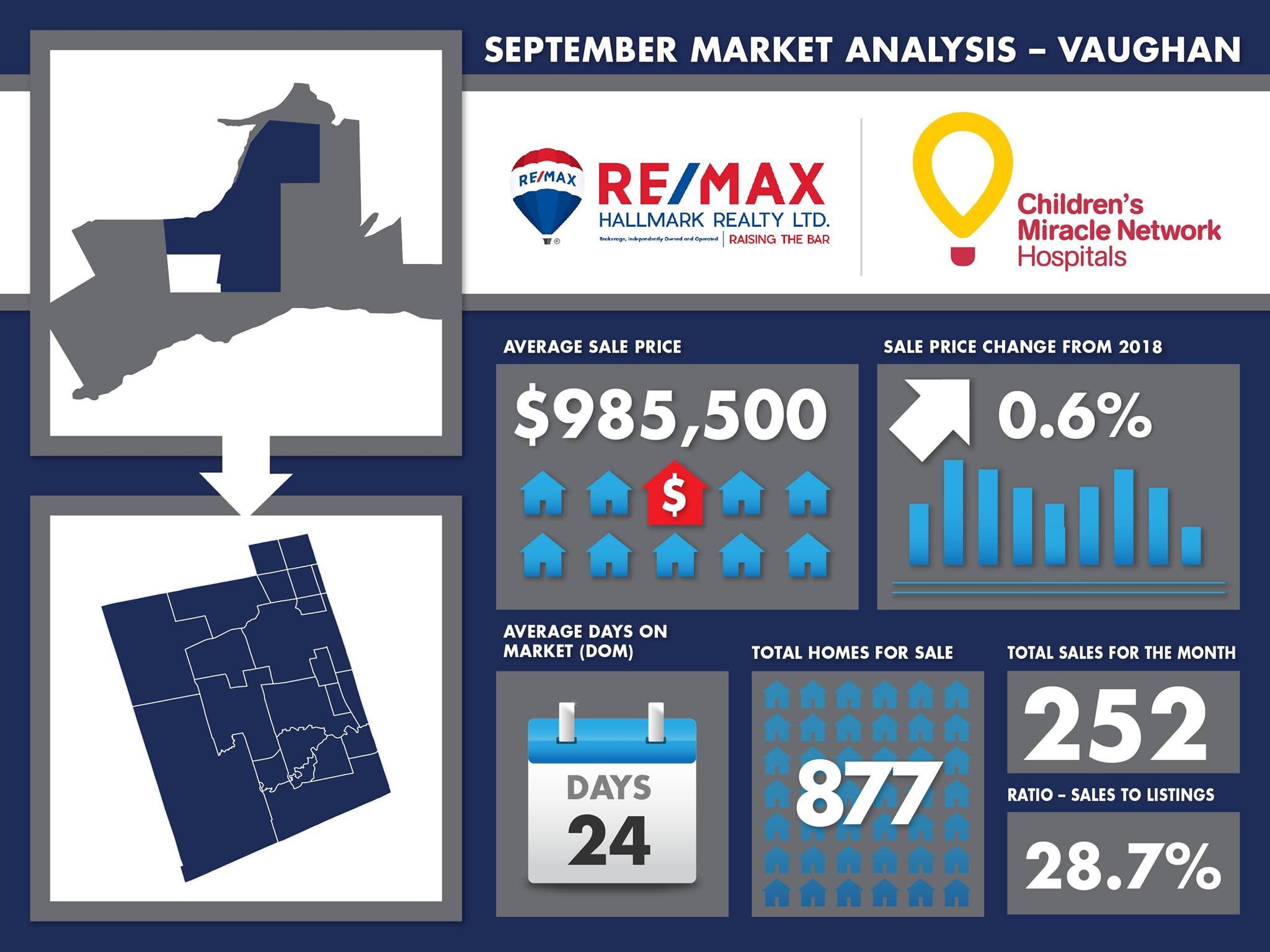

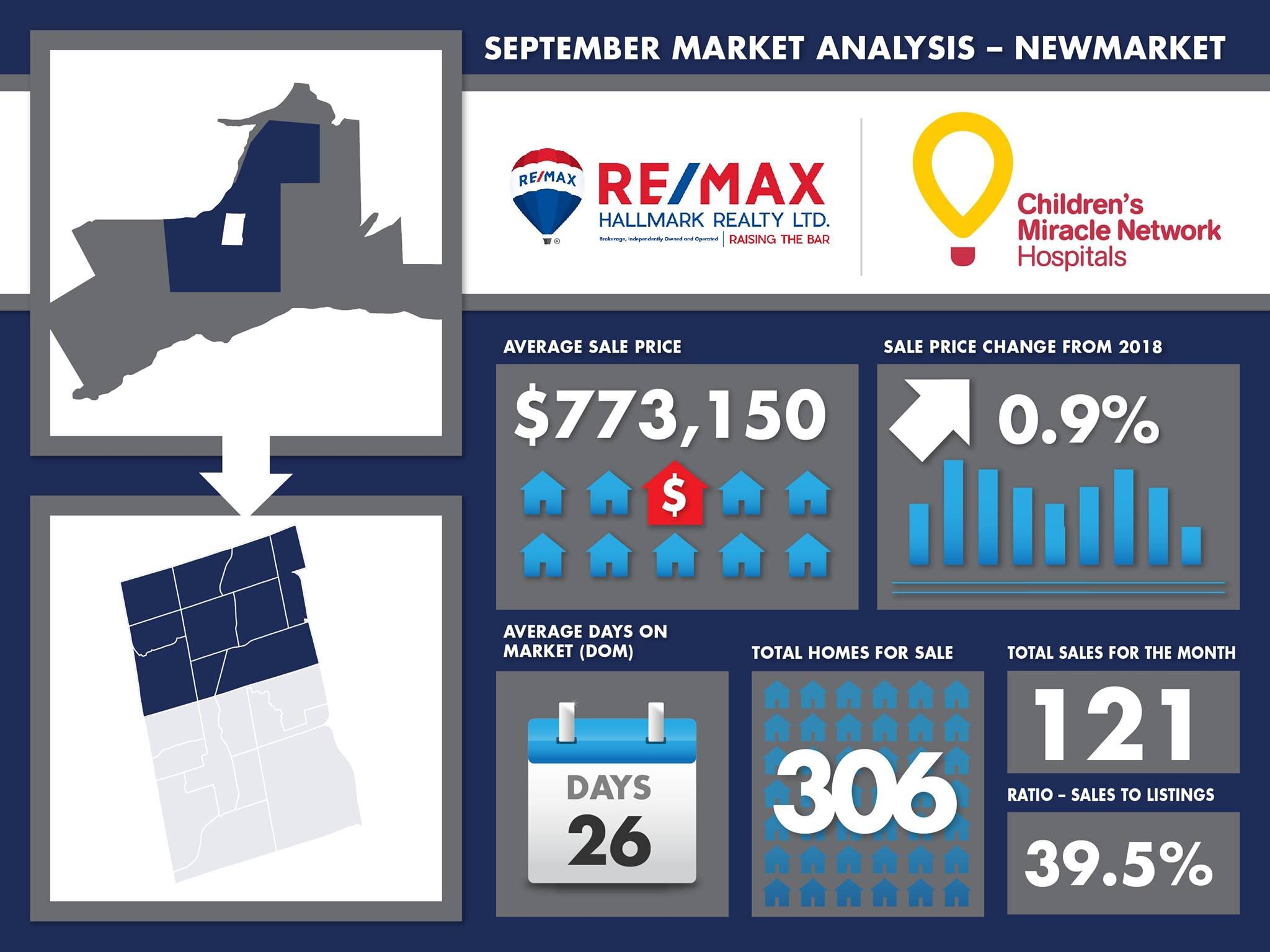

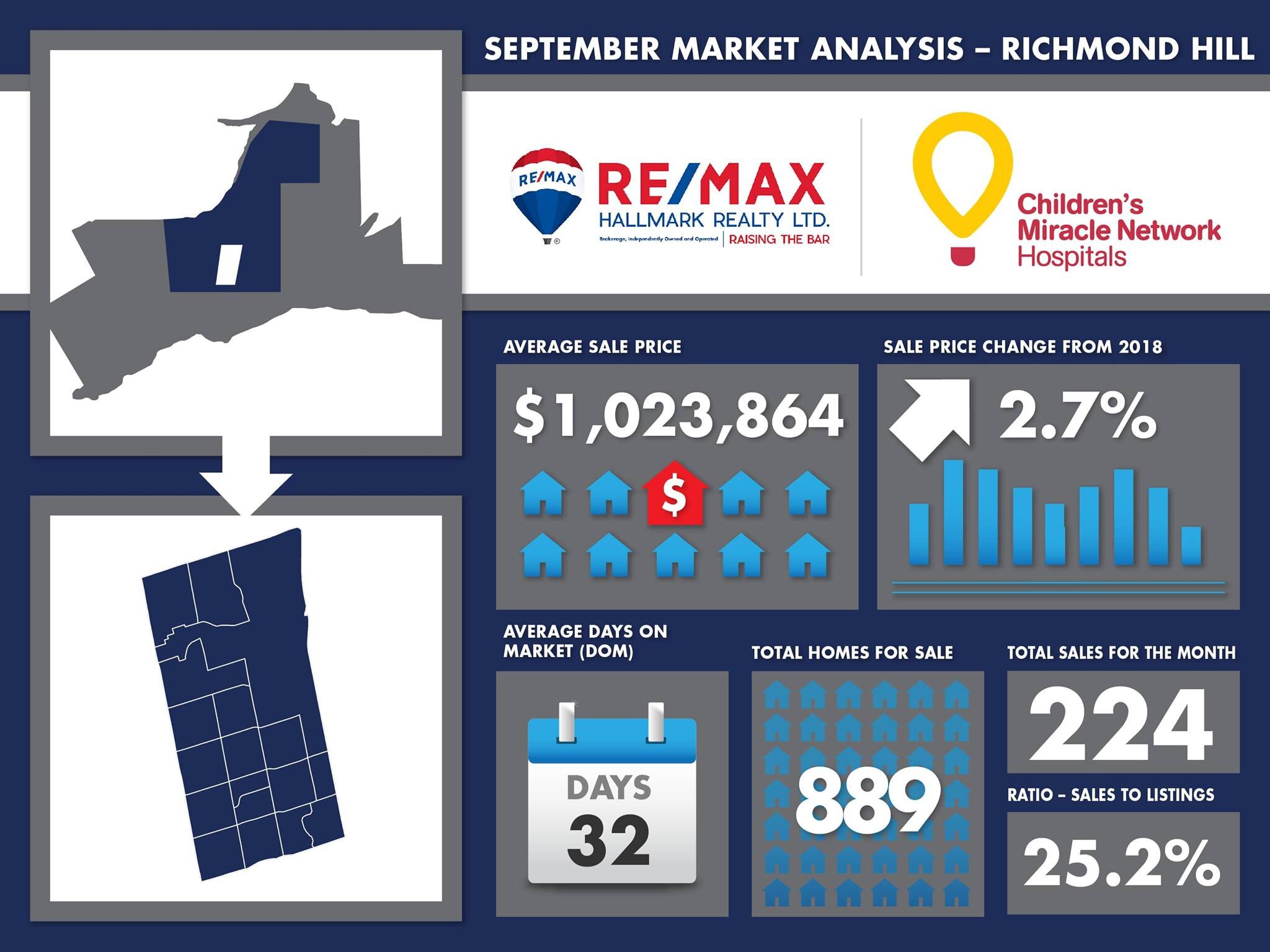

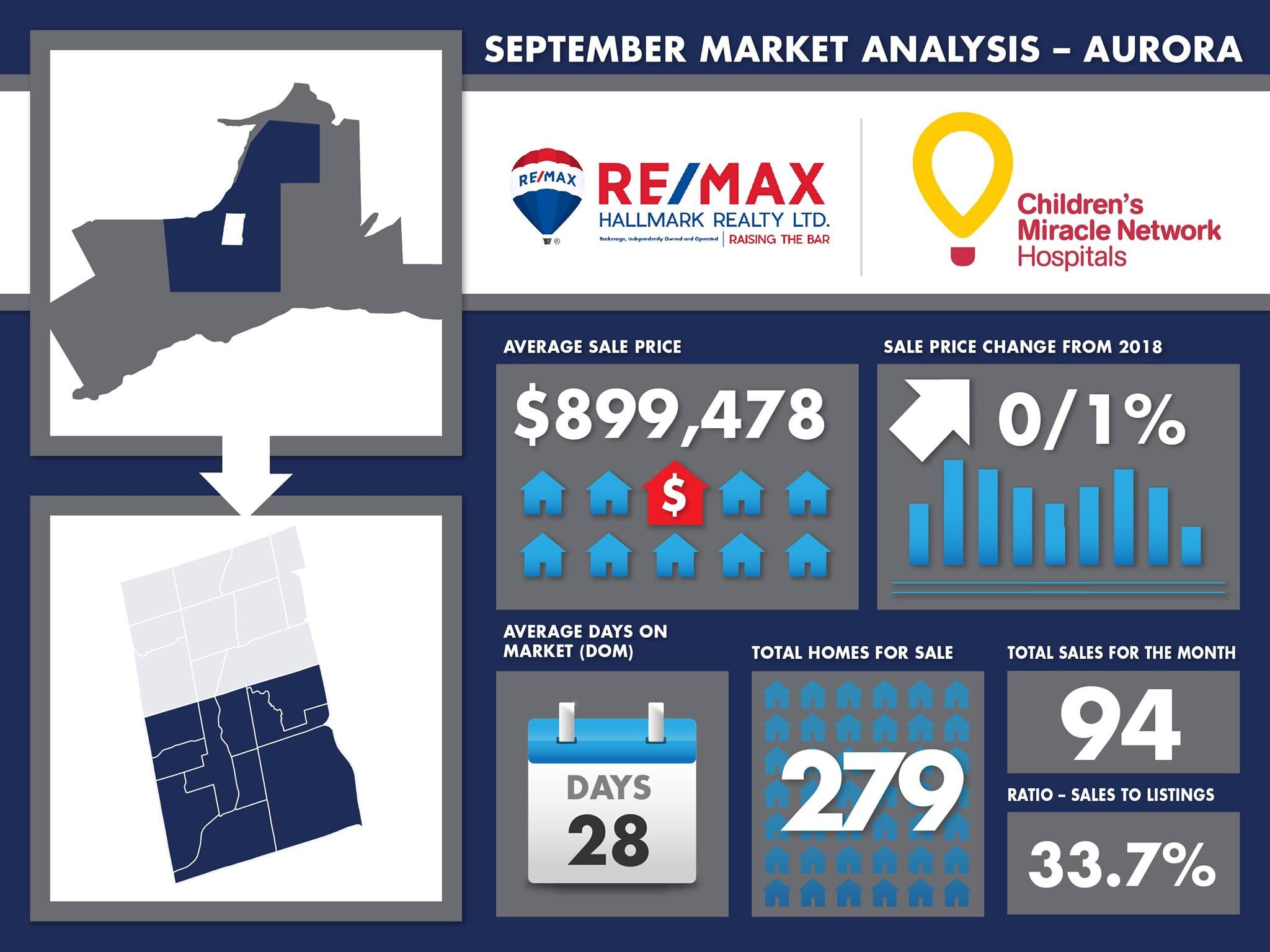

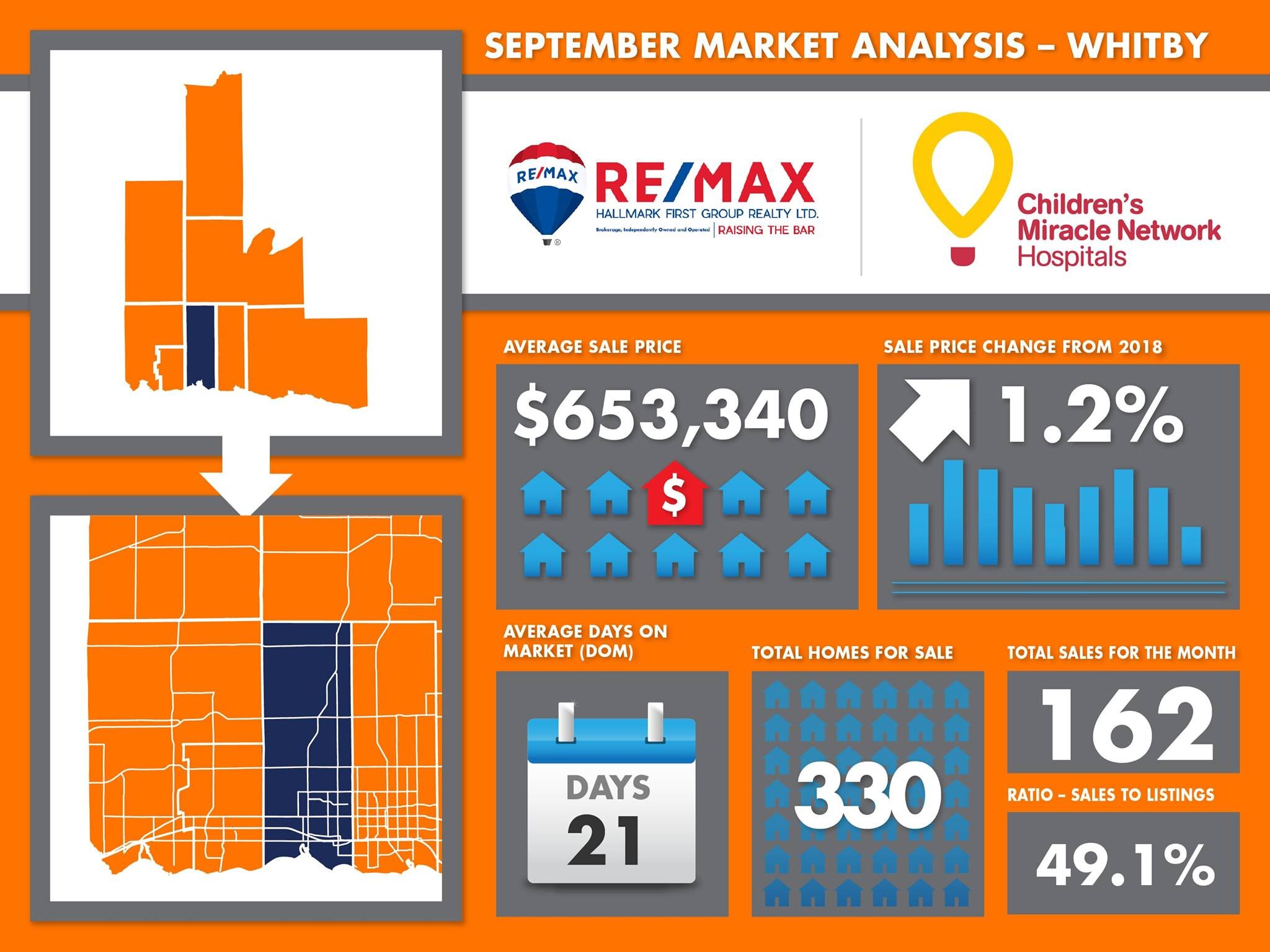

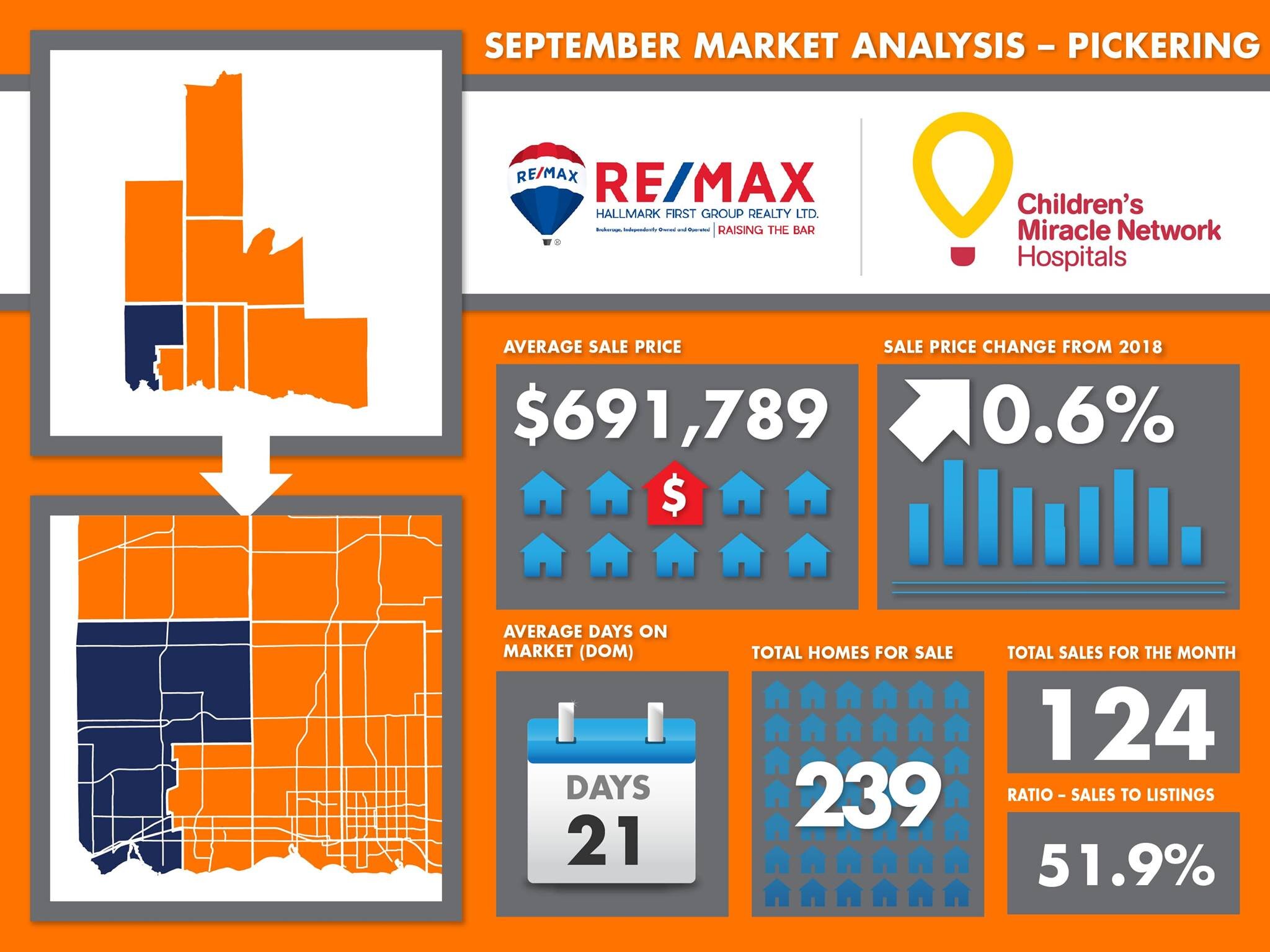

Sales numbers have now increased in many 905 neighbourhoods although appreciation percentages are lower across the board in the 905.

September usually means the start of the fall market where more condos and houses are listed and sales increase from the summer months although that didn’t happen this year. This trend may follow through for the rest of the fall market thru the end of November.

*Source Thomas Cook, Remax Hallmark Realty Ltd., Brokerage

Press Release: Bank of Canada keeps rates the same

The Bank of Canada today maintained its target for the overnight rate at 1 ¾ per cent. The Bank Rate is correspondingly 2 per cent and the deposit rate is 1 ½ per cent.

Global economic growth has slowed by more than the Bank forecast in its January Monetary Policy Report (MPR). Ongoing uncertainty related to trade conflicts has undermined business sentiment and activity, contributing to a synchronous slowdown across many countries. In response, many central banks have signalled a slower pace of monetary policy normalization. Financial conditions and market sentiment have improved as a result, pushing up prices for oil and other commodities.

Global economic activity is expected to pick up during 2019 and average 3 ¼ per cent over the projection period, supported by accommodative financial conditions and as a number of temporary factors weighing on growth fade. This is roughly in line with the global economy’s potential and a modest downgrade to the Bank’s January projection.

In Canada, growth during the first half of 2019 is now expected to be slower than was anticipated in January. Last year’s oil price decline and ongoing transportation constraints have curbed investment and exports in the energy sector. Investment and exports outside the energy sector, meanwhile, have been negatively affected by trade policy uncertainty and the global slowdown. Weaker-than-anticipated housing and consumption also contributed to slower growth.

The Bank expects growth to pick up, starting in the second quarter of this year. Housing activity is expected to stabilize given continued population gains, the fading effects of past housing policy changes, and improved global financial conditions. Consumption will be underpinned by strong growth in employment income. Outside of the oil and gas sector, investment will be supported by high rates of capacity utilization and exports will expand with strengthening global demand. Meanwhile, the contribution to growth from government spending has been revised down in light of Ontario’s new budget.

Overall, the Bank projects real GDP growth of 1.2 per cent in 2019 and around 2 per cent in 2020 and 2021. This forecast implies a modest widening of the output gap, which will be absorbed over the projection period.

CPI and measures of core inflation are all close to 2 per cent. CPI inflation will likely dip in the third quarter, largely because of the dynamics of gasoline prices, before returning to about 2 per cent by year end. Taking into account the effects of the new carbon pollution charge, as well as modest excess capacity, the Bank expects inflation to remain around 2 per cent through 2020 and 2021.

Given all of these developments, Governing Council judges that an accommodative policy interest rate continues to be warranted. We will continue to evaluate the appropriate degree of monetary policy accommodation as new data arrive. In particular, we are monitoring developments in household spending, oil markets, and global trade policy to gauge the extent to which the factors weighing on growth and the inflation outlook are dissipating.

Information note

The next scheduled date for announcing the overnight rate target is May 29, 2019. The next full update of the Bank’s outlook for the economy and inflation, including risks to the projection, will be published in the MPR on July 10, 2019.

*Source Bank of Canada April 24, 2019

Province unveils plans to alter four big transit projects

Premier Doug Ford has unveiled his vision for a transit plan that would introduce some major changes to several transit projects that are already underway in Toronto.

The plan would see the provincial government commit $11.2 billion to an overall plan that would cost $28.5 billion.

The announcement Wednesday includes plans for the downtown relief line, the Scarborough subway extension, the Yonge North subway extension of Line 1, and the Eglinton West LRT project.

The provincial plan would rely heavily on further investment from the federal government, seeking up to 40 per cent of the cost from Ottawa. That 40 per cent stake would include $4.8 billion in previous federal commitments to transit infrastructure in Toronto. The province is hoping that $2.25 billion of the extra $6.6 billion that it wants from Ottawa will come through the green infrastructure stream.

The plan would also rely on “significant investments” from the city of Toronto and York Region.

While the exact numbers have not yet been worked out, Ford said that discussions with the city have been positive so far.

While the premier said that provincial and municipal officials have spent “hundreds” of hours discussing the plan, it’s not clear how much the city knows so far about what the province is asking. Mayor John Tory did not attend Wednesday’s announcement, saying he could not attend an announcement about an infrastructure project that he doesn’t know anything about.

Describing it as “fabulous” and “the best ever,” Ford said the new transit system would serve the GTA for the next 50 to 100 years and added that the province is able to build transit “faster, better, cheaper” than the city.

“We’re going to get the largest system in Canada moving,” Ford said.

Asked what he would do if the federal government does not come to the table with the funds, Ford said the province would be willing to foot the entire bill and said he’d be willing to stake his reputation on the plan.

“If need be, we’ll backstop it ourselves,” he said

Major changes to relief line

Some of the most drastic changes affect the planned downtown relief line.

The provincial plan would rename the relief line “The Ontario Line” and would change the project from a subway line that connects with the rest of the TTC system into a “free-standing transit artery.”

The province says that driverless trains, lighter, smaller and more frequent vehicles and elevated track portions could all be part of the new line.

While it appears that the technology for building the route has not yet been decided, the government says that it will “invite the market” to offer cheaper technologies.

The alignment is also different from what the city has planned so far. Current plans for the downtown relief line envision it running between Pape and Osgoode stations. According to the province, the Ontario Line would connect Ontario place downtown with the Ontario Science Centre near Don Mills Road and Eglinton Avenue , also connecting at East Harbour GO, Pape, Queen and Osgoode stations.

The line would cost $10.9 billion and would have an estimated completion date of 2027.

The latest estimate for the city’s relief line plan is $7.2 billion. TTC staff have said that they were expecting more detailed design work for the line to be compete early next year, along with an updated cost estimate.

Scarborough subway extension

The province also plans to spend $5.5 billion to build a three-stop subway extension in Scarborough instead of the planned one-stop extension.

“This one’s for you, Rob,” Premier Ford said in a nod to his late brother and former mayor Rob Ford, who championed the idea of building a subway in Scarborough.

The Scarborough extension, as envisioned by the province, would include stops at Lawrence East, Scarborough Town Centre and McCowan Road.

City council had previously considered building the three-stop subway, but had rejected it over cost concerns.

The change would add $1.6 billion to the latest cost estimate for building the one-stop subway. Ford said Wednesday that the province is willing to pay the entire cost of the Scarborough extension if need be.

The estimated completion date for the project would be 2029-2030, according to the province.

Yonge North Subway extension

Ford said the extension of Line 1 along Yonge Street from Finch Station to Richmond Hill Centre would be fast-tracked so that it is built concurrently with the Ontario Line.

Various levels of government have committed to eventually building the extension, but the TTC has said that it would not make sense to do so until there is a relief line, as the extension would likely add passengers to an already overwhelmed subway line.

Ford said the $5.6 billion project would only open after the proposed Ontario Line is built.

Eglinton Crosstown West

The provincial plan would alter the planned Eglinton West LRT project so that the line is buried between Royal York Road and Martin Grove Road.

The project would cost $4.7 billion with an estimated completion date of 2031.

The province said that it would like to ultimately connect the line to the airport, but that part is not planned currently.

First part of subway upload coming this spring

The province also says that it will split a planned upload of the TTC subway system into two parts. The first part of the upload would give the province responsibility for building all new subway infrastructure. The province says legislation will be introduced this spring to make that happen.

Discussions would then continue with the city about the upload of existing subway infrastructure, with an aim of introducing legislation to do so sometime next year.

According to a recent report by city staff, the city has already spent roughly $224 million over the past few years on planning for priority transit projects.

It’s not clear how much of that planning is still relevant given the provincial changes. However Ford said Wednesday that none of that work will have been wasted.

“We’re going to utilize every bit of the planning,” he told reporters.

Province says it can build faster, cheaper

According to background documents, provincial officials believe for several reasons that they are better positioned to deliver major transit infrastructure projects that the city is.

Those reasons include the ability to amortize costs over long periods, streamlining of permits and approvals, and the ability to relocate utilities where need be.

“The mayor understands. He doesn’t have the funds,” Ford said.

He reiterated that while he thinks the TTC is good at operating subway systems, he doesn’t think it is good at building them.

“It’s not their fault. They just can’t get it done,” Ford said.

The province believes that it can deliver cheaper transit infrastructure more quickly by changing the delivery method from the tradition plan-bid-build model. The province said it will seek public-private partnerships to try and build some of the new transit infrastructure.

Mayor John Tory is expected to comment on the provincial plan later this afternoon.

*Source - https://www.cp24.com/news/province-unveils-plans-to-alter-four-big-toronto-transit-projects-1.4373196?fbclid=IwAR2fI92p4Wl-yv__W4lC2rWw7zbeBkXM8EU_6WV62LrAjqR3l2RLCktnqrY

Written by Joshua Freeman

April 9 2019

State of the Market Episode 3.3 | Reviewing the Federal Budget

On this episode of State of the Market, The Federal Finance Minister came out with a pre-election year budget including some new incentives for home buyers and a fair bit of spending. Ravi discusses what it could mean for the real estate market in the GTA...

*Facebook Live March 22nd 2019

Ravi Singh was name one of the most Interesting People in Real Estate by Inman News in 2016. Award winning Realtor with ReMax Hallmark and team leader at The Connexus Group.

It's Tax Time! 5 great ways to put your refund to work.

Smart Ways to Spend Your Income Tax Refund

You’ve filed your taxes (or you’re planning to very soon) and you’re expecting an income tax refund. To some, this perceived windfall can be a sign to go on a spending binge.

According to Canada Revenue Agency, the average income tax refund for the 2018 tax year to date is $1,735 – about the cost of an all-inclusive vacation for one in the sunny south, a few nice dinners out, or a very decent shopping spree.

If you’re getting an income tax return, that means you’ve overpaid taxes and you’re simply getting some of that back. Stop treating your tax refund as “extra” cash. Here are some smart ways to put that tax refund to work.

Pay Down Debt.

It’s unlikely that you’ll miss this chunk of money, since you’ve technically already paid your taxes and are just getting some of that back. Use it to pay off some debt and reduce the interest you’re paying on that loan. Less interest paid means more money in the bank for your living expenses.

READ MORE: How much will it cost to buy a house?

Stash it away.

Leaving that cash in a savings or chequing account makes it easy to access – and spend. Take advantage of tax savings in 2018 by depositing your 2017 refund into your Registered Retirement Savings Plan or a Tax-Free Savings Account.

READ MORE: How to buy a home you can afford

Update your home.

While your tax refund may not be enough to fund a full-blown renovation, the average refund is definitely enough to cover some upgrades in your home. This can boost your return if you’re planning to sell this spring. If you’re planning to stay in the home, you’ll enjoy the added liveability – and some shiny new faucets!

READ MORE: Boost your home’s value with $1,000 or less

Boost your mortgage payment.

Depending on your mortgage terms and conditions, you may be able to make a lump-sum payment. You’ll pay less in interest and more in principal. While $1,765 may seem like a drop in the bucket, every dollar counts.

READ MORE: Understanding mortgages

Build your down payment.

If home ownership is part of your future plan, deposit your tax refund into a “down payment” fund. An RRSP is a great option. You’ll enjoy a tax break, and you can borrow up to $25,000 (tax-free!) for your down payment and other home purchase-related costs when you’re ready to buy.

READ MORE: What is a down payment?

Always consult your financial advisor to determine the best solution for your needs and goals.

*Source https://blog.remax.ca/smart-ways-spend-income-tax-refund/?sf99550259=1&fbclid=IwAR06dWCwIeGAZ9oAbIbPHa2Gwz3OEipOJ0Z2-z2LVyp6yJzJyWvhM58DtHQ

State of the Market Episode 3.2 | Key info going into the Spring 2019 Market!

State of the Market Episode 20 | 2019 Real Estate Projections

Here are some top level data points which I've added commentary on above:

Significant real estate milestones for Toronto / GTA in September 2018… a slow start to the fall market.

2nd lowest September sales since 2012 (6,455)

The ratio of sales-to-listings decreased slightly to 32.1% in September – Now in a very moderate seller market territory

The average sale price came in at $796,786– which was up just 2.9% compared to September 2017 – Remember last year the new Ontario government rules came into effect on April 20th which really influenced the late spring and summer markets last year

Note that this average was still over 5.4% higher than 2 years ago in September 2016

Overall sales in the month were up just 2% from one year ago

The GTA real estate market overall averaged the days-on-market at 26 – a fairly typical level for Toronto’s early fall market

Detached home sales in September 2018 with a purchase price over $2,000,000 were almost the same as last year

It’s noticeable that first-time buyer aspirations are now shifting to a condominium lifestyle – CONDO sales took a 35.4% share of the total market

Downtown condo active listing numbers were lower in C01 and C08 by 8-10% from last year at this time

The downtown condo days-on-market average was 20-21 days – significantly faster than the overall market

The ratio of sales-to-listings for condos downtown were close in both C01 (61.7%) and in C08 (65.1%) indicating an extremely strong seller’s market… a wee bit more than double the GTA overall.

The average sale price for downtown condominium suites is up by roughly $65,000 from September 2017

Building on this higher demand due to better affordability, condo appreciation in the two main downtown markets averaged 11-13% year-over-year

Markets in York Region and other 905 neighbourhoods have suffered the most from the market slowdown – York Region is now showing that they’re in ‘buyer market’ territory

Expect slight inventory and sales increases as we move through the fall/Winter market - buyers should watch for more opportunities to get the condo or house of their dreams.

The key takeaways include the fact that the recovery is in motion... starting from the bottom up. Now is a great chance to get into your dream home, upsize or invest.

As always, Happy to talk!

Ravi Singh was name one of the most Interesting People in Real Estate by Inman News in 2016. Award winning Realtor with ReMax Hallmark and team leader at The Connexus Group.

State of the Market Episode 10 | Stories from the Frontline

On this episode of State of the Market, Ravi discusses both seller and buyer situations that we have had to experience in the last few weeks in the crazy spring market we are having!

Ravi Singh was name one of the most Interesting People in Real Estate by Inman News in 2016. Award winning Realtor with ReMax Hallmark and team leader at The Connexus Group.

RE/MAX 2018 Spring Market Trends Report

NEW STRESS TEST REGULATIONS PROMPT CANADIAN HOMEBUYERS TO INCREASE BUDGETS, RE-EVALUATE HOME FEATURES OR DELAY THEIR PURCHASE. WHILE HOMEBUYERS ARE FEELING THE IMPACT OF REGULATORY CHANGES, THE SPRING MARKET FORECASTS BRIGHTER DAYS AHEAD.

A recent RE/MAX survey conducted by Leger found more than one in four Canadian homebuyers report feeling pinched by the stress test, which came into effect in January of this year. However, projections for the spring market show optimism with most markets expected to remain stable or improve.

Despite all of the factors involved, the spring market across most of the country is forecasted to strengthen as we head into the warmer months. Supply is still low in many markets, and while the prices may not reach the same levels as this time last year, we are expected to see continued healthy price appreciation from the earlier months of this year across many regions in the country.

The average residential sale price in the Greater Toronto Area dropped to $753,747, down almost 10 per cent from $834,144 in January and February of 2017. With move-up buyers driving the market — many of whom are making their second or third transition — alongside a booming condominium market, prices are forecasted to soften throughout the year. Not all regions in Ontario are being affected like the GTA. In Ottawa, the average residential sale price in January and February was $388,289, up four per cent from the same period in 2017, and Kitchener-Waterloo saw a five per cent price increase year-over-year.

At the same time, the average residential sale price in Western Canada continues to increase. Greater Vancouver saw prices increase almost 11 per cent in January and February to $1,051,513, up from $950,184 during the same period in 2017. Despite reduced unit sales, prices are expected to continue rising. While Victoria is mostly a seller’s market compared to Greater Vancouver, it has also seen an increase in average residential sale price, which was $831,000 in January and February this year compared to $761,000 during the same period in 2017.

It is expected that government intervention and the stress test will continue to play a pivotal role in purchasing behaviour as we look to the months ahead. The Leger survey found that four in 10 buyers have had to compromise on their purchase, and almost one in three opted not to purchase altogether. One quarter of buyers compromised on the size of their home, while 18 per cent made concessions on the location of their home.

Despite these compromises, 55 per cent of homebuyers say they feel like they can purchase the type of home that suits their families’ needs compared to 46 per cent last year.

In Alberta, first-time homebuyers looking for affordability in Calgary and Edmonton continue to drive the market forward, with single Millennials and young couples gravitating toward the relatively stable condominium market. The average residential sale price increased 1.4 per cent in Calgary to $481,775 in January and February of this year, up from $475,288 during the same period in 2017. Meanwhile in Edmonton, a wide variety of inventory offers good opportunities for buyers, resulting in a small increase in activity and stable year-over-year prices to start 2018.

Interestingly, activity in Atlantic Canada experienced increased demand from first-time homebuyers, many of whom are young couples and families. At the same time, the condominium market is being driven by retirees who are looking to downsize. Prices continue to rise across most Atlantic markets, especially in Saint John where the average residential sale price in January and February this year was $201,328, compared to $168,956 during the same period in 2017.

New residential and commercial development projects in markets across the country are expected to fuel demand. Cities most impacted will include Edmonton, Kelowna, Victoria and Fraser Valley in the West and Windsor, London, Hamilton-Burlington, Barrie, Durham, Ottawa, Saint John and Halifax in Central and Eastern Canada.

Click Here for the Full Report

*Source: Re/Max Ontario-Atlantic

Connexus Perks: Re/Max Hallmark Scholarship Fund

We are happy to announce that Re/Max Hallmark is offering a Fall 2018 Scholarship Fund for the children of RE/MAX Hallmark’s past or present clients, who are applying for their first year of post-secondary education.

If you require further information, or would like to obtain an application form and inquire about guidlines, please contact Alicia at 416.494.7653 or via email alicia@connexusgroup.ca. We would be happy to endorse your child in our Scholarship Program to help with their education.

Deadline to submit is April 24th 2018.

At Re/Max Hallmark, we feel strongly about contributing to the minds of tomorrow and investing in the future of our children.

Best Regards,

Ravi, Justin, Sarah and Alicia and Angela.

#theconnexusadvantage

The Marginal Buyer - "A take on the competitive nature of multiple offers."

You win some... You lose some. That's the tale of the Toronto market for buyers. Though lately we've been winning a lot. Very proud to know that we've been able to help 6 families purchase in the last 45 days in multiple offers. Many of them have lost in multiples over the past 3-4 months. Many buyers out there know the heartache and the agony of defeat. In the past year, we've worked on a strategy around what we call the

"marginal buyer"

In our buyer process, we level set all of the expectations around a multiple offer situation based on "the marginal buyer". You see the marginal buyer is our only real competition. The marginal buyer is our neck and neck stiff competition. Some of the key characteristics of the marginal buyer:

- knows values in the area

- knows absorption rate in the area

- can define whether the area is a sellers market, buyers market or balanced market

- is intimately aware of recent sales

- understands all elements of an offer

- comes equipped with pre-qualification and if possible pre-approval for financing

- understands all 9 elements of a home inspection

- has thorough knowledge of the condo/strata declaration and status certificate as applicable

- comes with a deposit to the offer (don't ever walk without a deposit!)

- has a strong guide on the purchase process

- has a guide who can advise on future value albeit without the ever-valuable crystal ball.

The marginal buyer is our stiff competition because they are the most aware of the cost-benefit of buying a particular property. Once we've scoped out our competition, the next step is to analyze the "logical" approach to historical and current data. Then... and only then... comes the all important question:

"How much would be too much? And if this property sells for too much, would you buy it for that price?".

Interesting situation right? Only in Toronto is this how purchases are qualified. Here's another way to look at it:

"With prices climbing at x% per month... would you be willing to pay what this home will be worth in 1-2-3-4 months?"

Finally, here's how we usually set up the conversation:

Based on current data of inventory, market dynamics and recent sales, the property is:

a) a steal at X dollars

b) a deal at y dollars

c) you're overpaying at z dollars

After we've examined it, the only last step is to figure out whether the marginal buyer is likely to offer more then us. And if they are, we have to answer whether we are ok with it.

And guess what... if you've offered and won.. based on going through the exercise and homework above, that's right, you've guessed it... YOU ARE the marginal buyer. And congrats, you've just bought a home in this crazy Toronto real estate market.

NB: Justin, Sarah and Alicia have all bought homes in multiple offer situations. We don't just preach it, but we practice it too!

Want to talk Real Estate? Got questions... call/message any time!

Ravi Singh

Ravi Singh was named one of the most Interesting People in Real Estate by Inman News in 2016. Award winning Realtor with ReMax Hallmark and team leader at The Connexus Group.

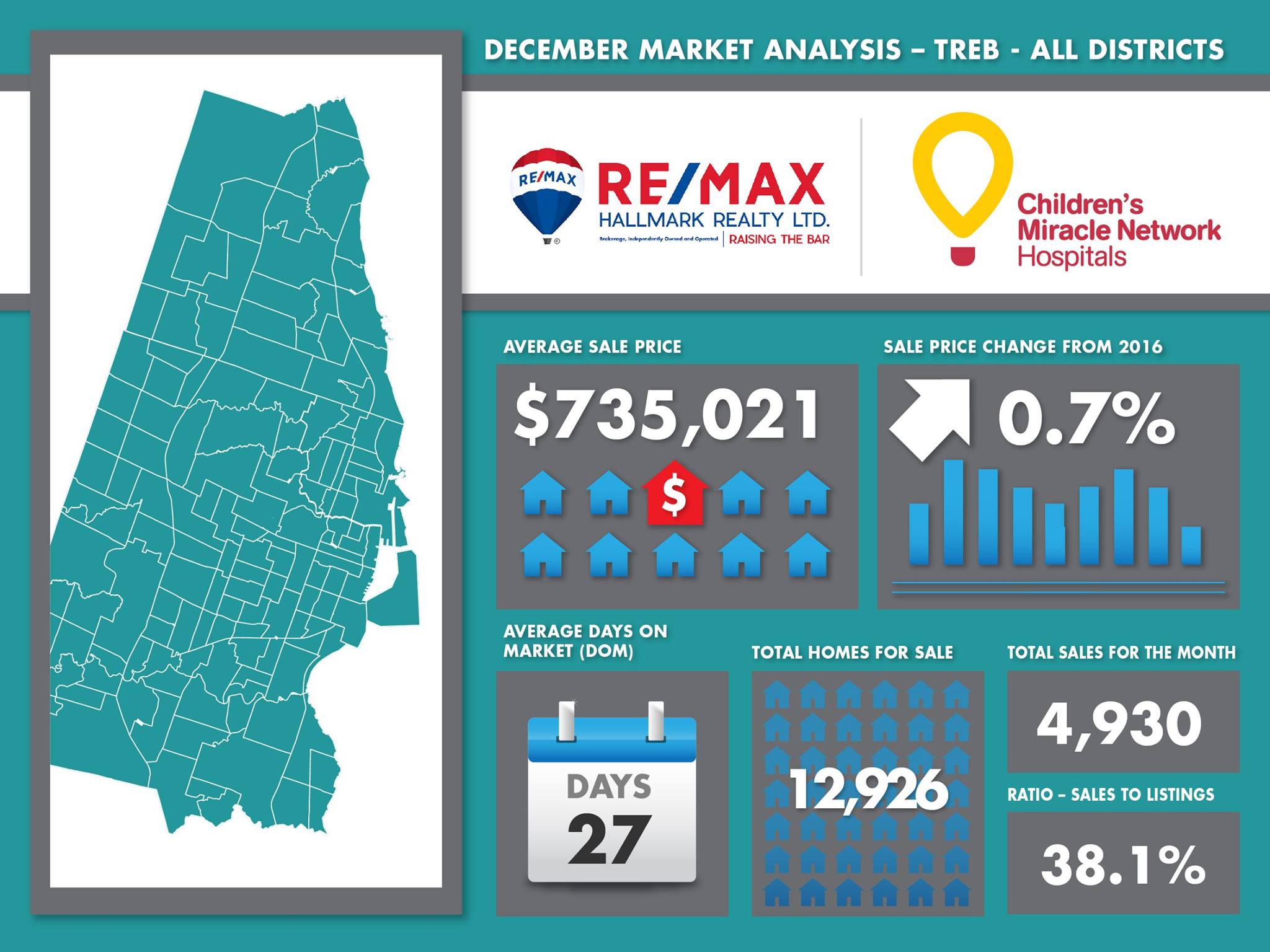

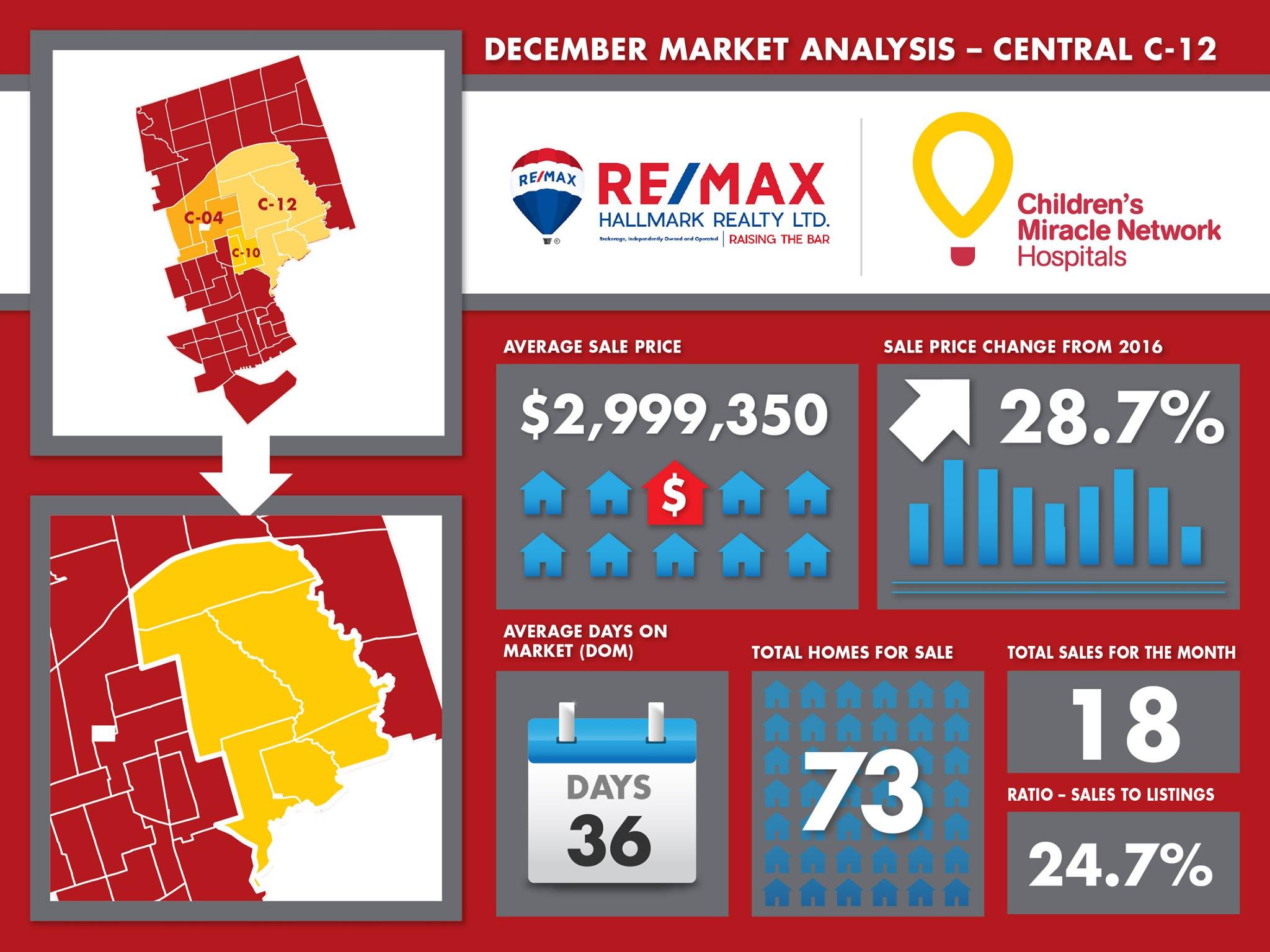

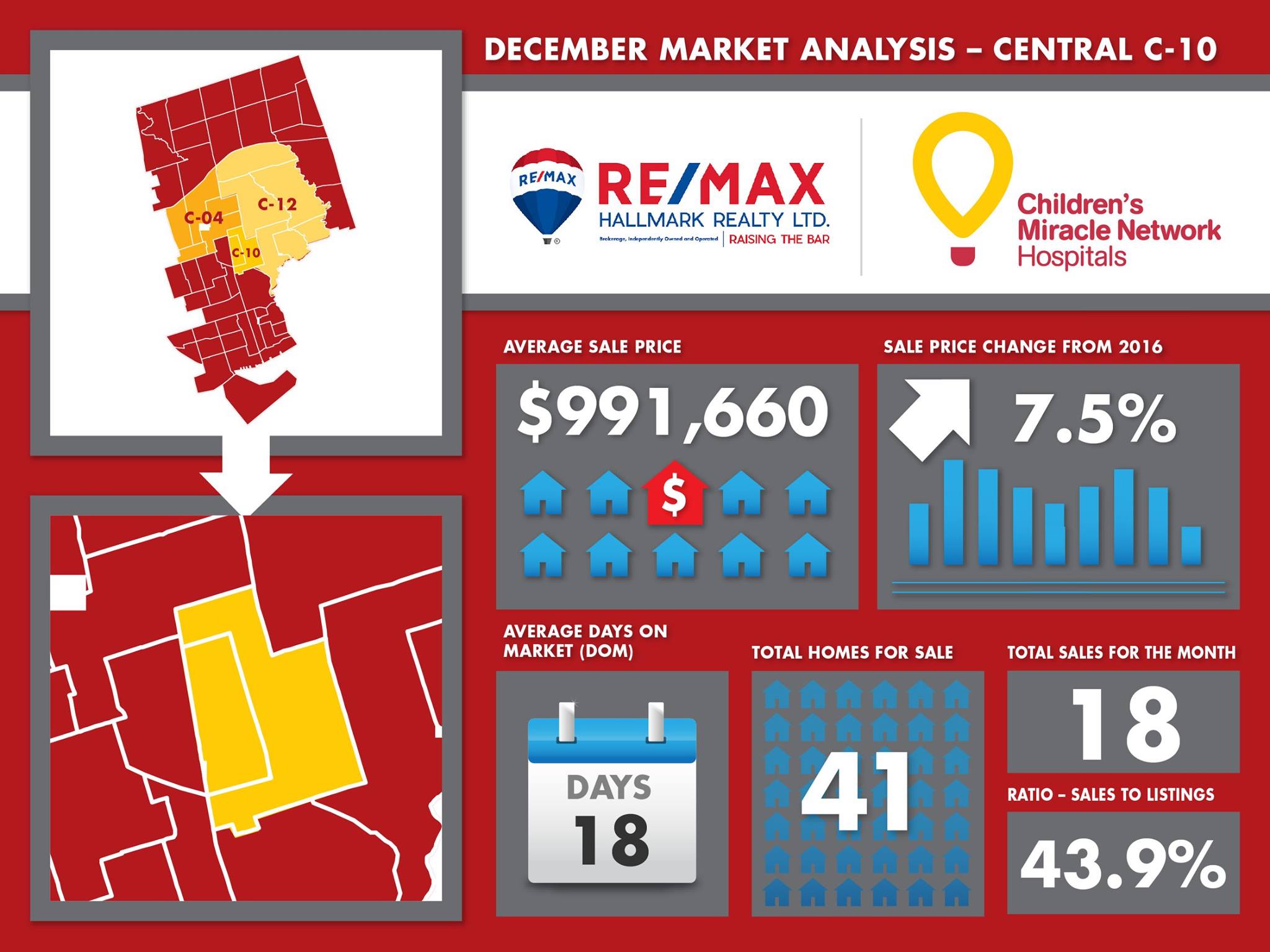

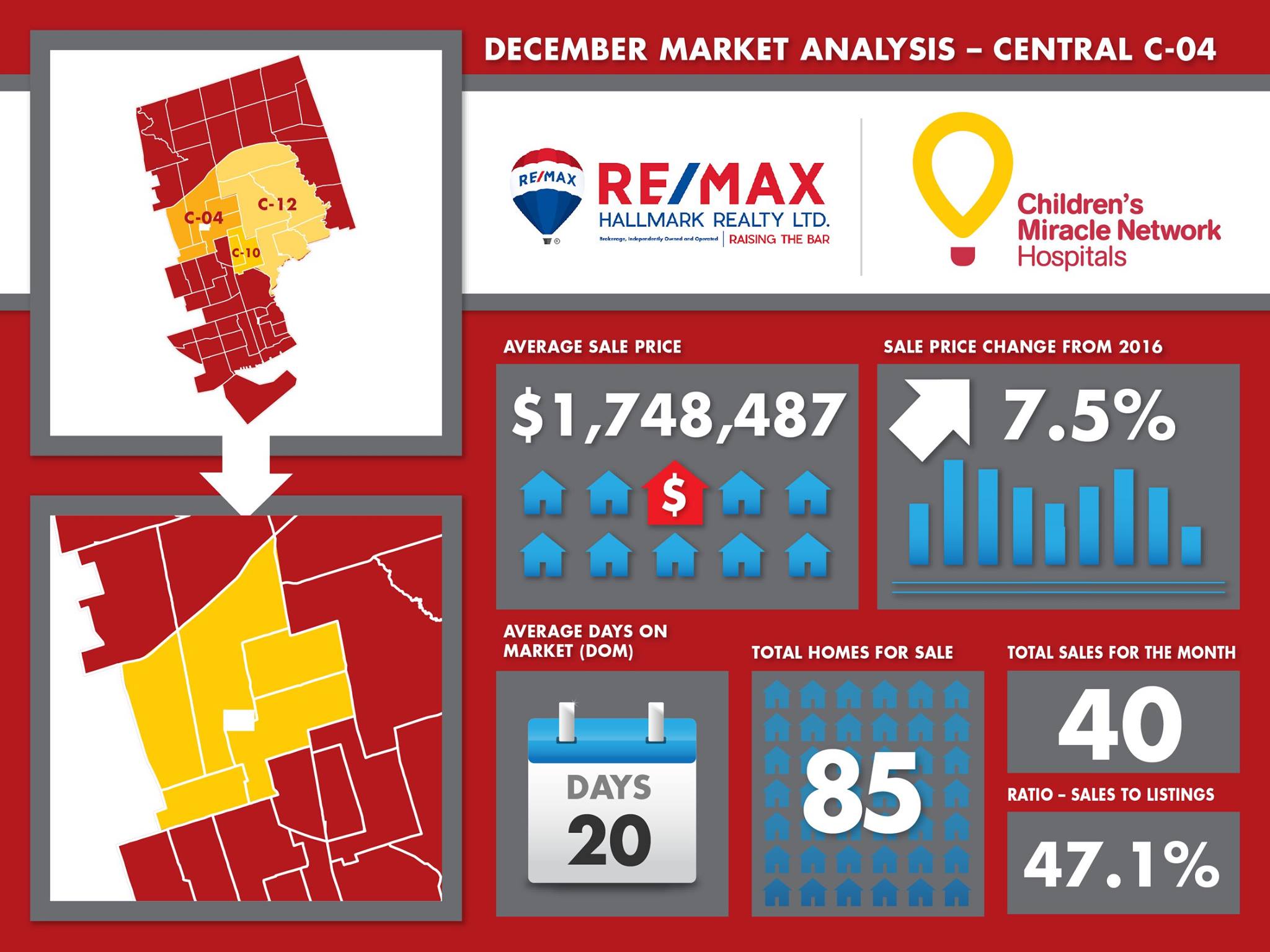

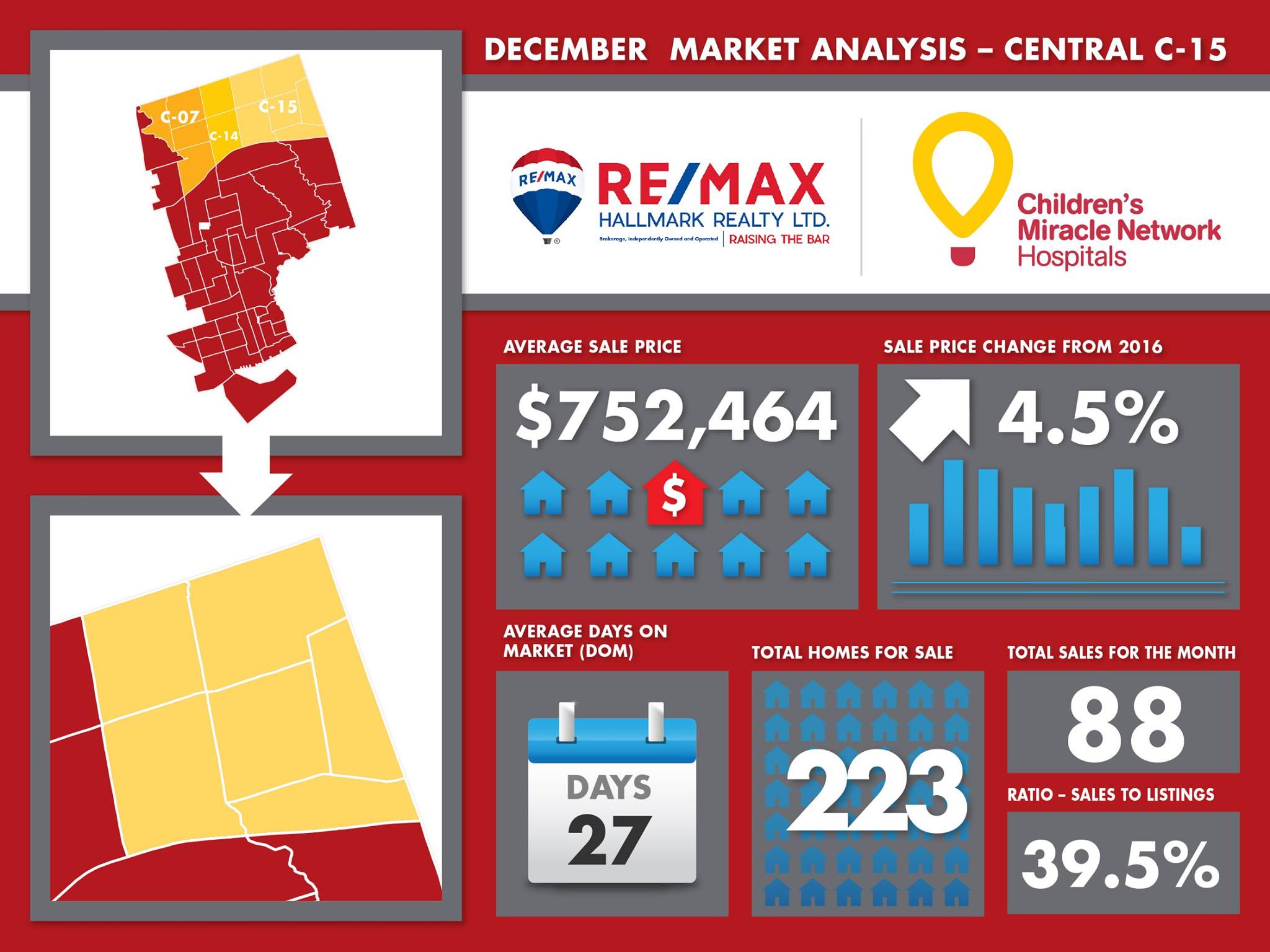

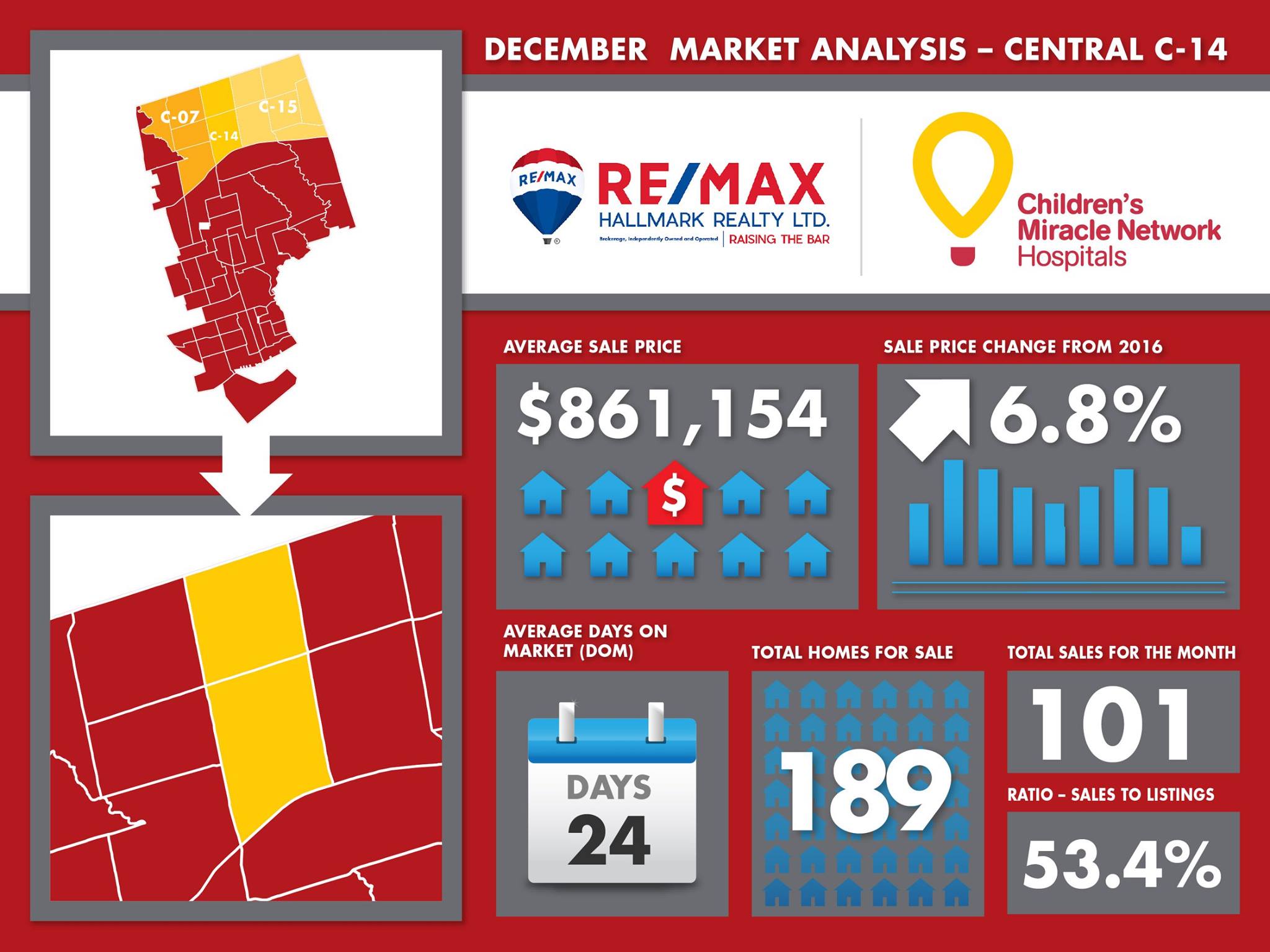

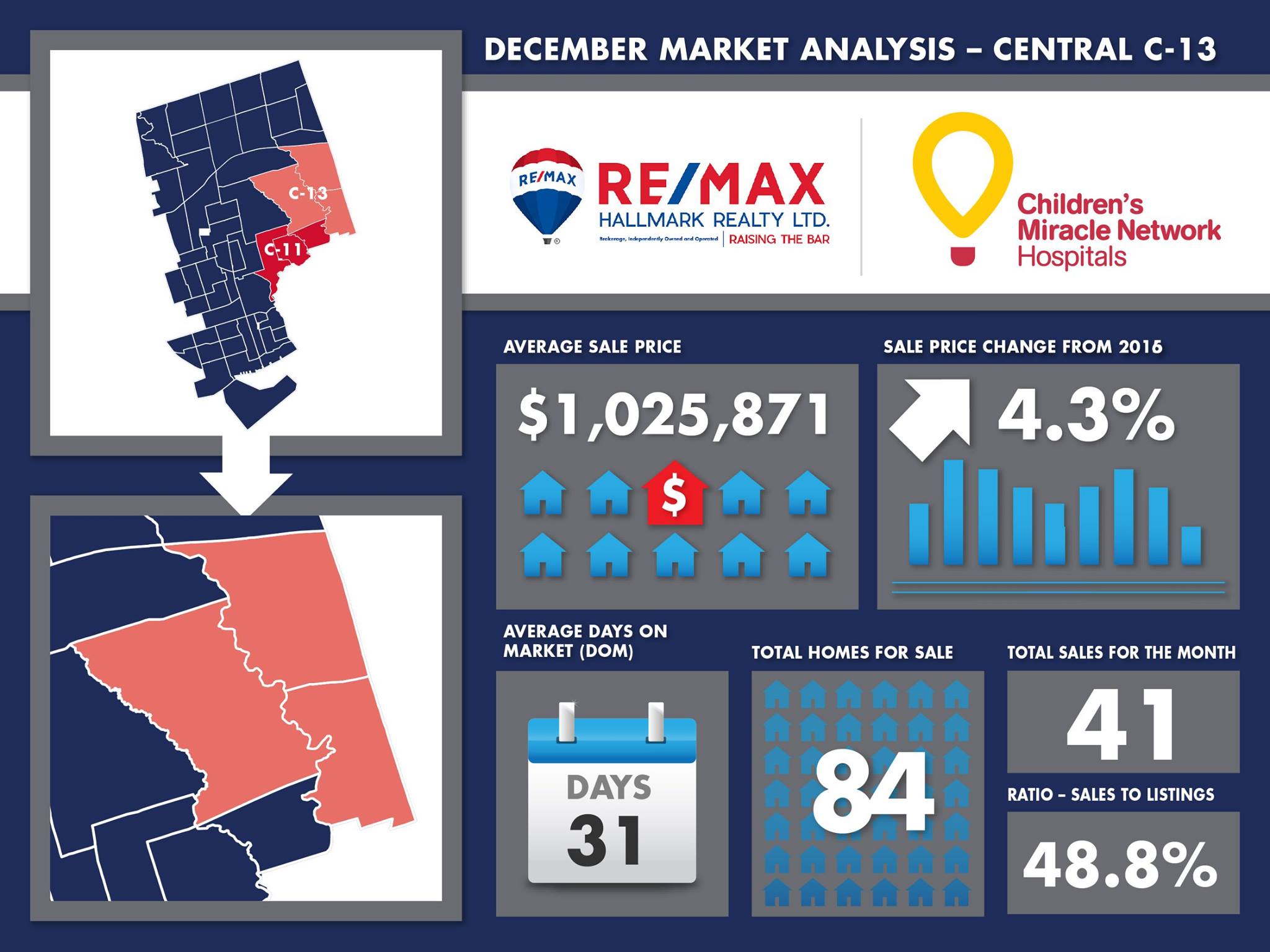

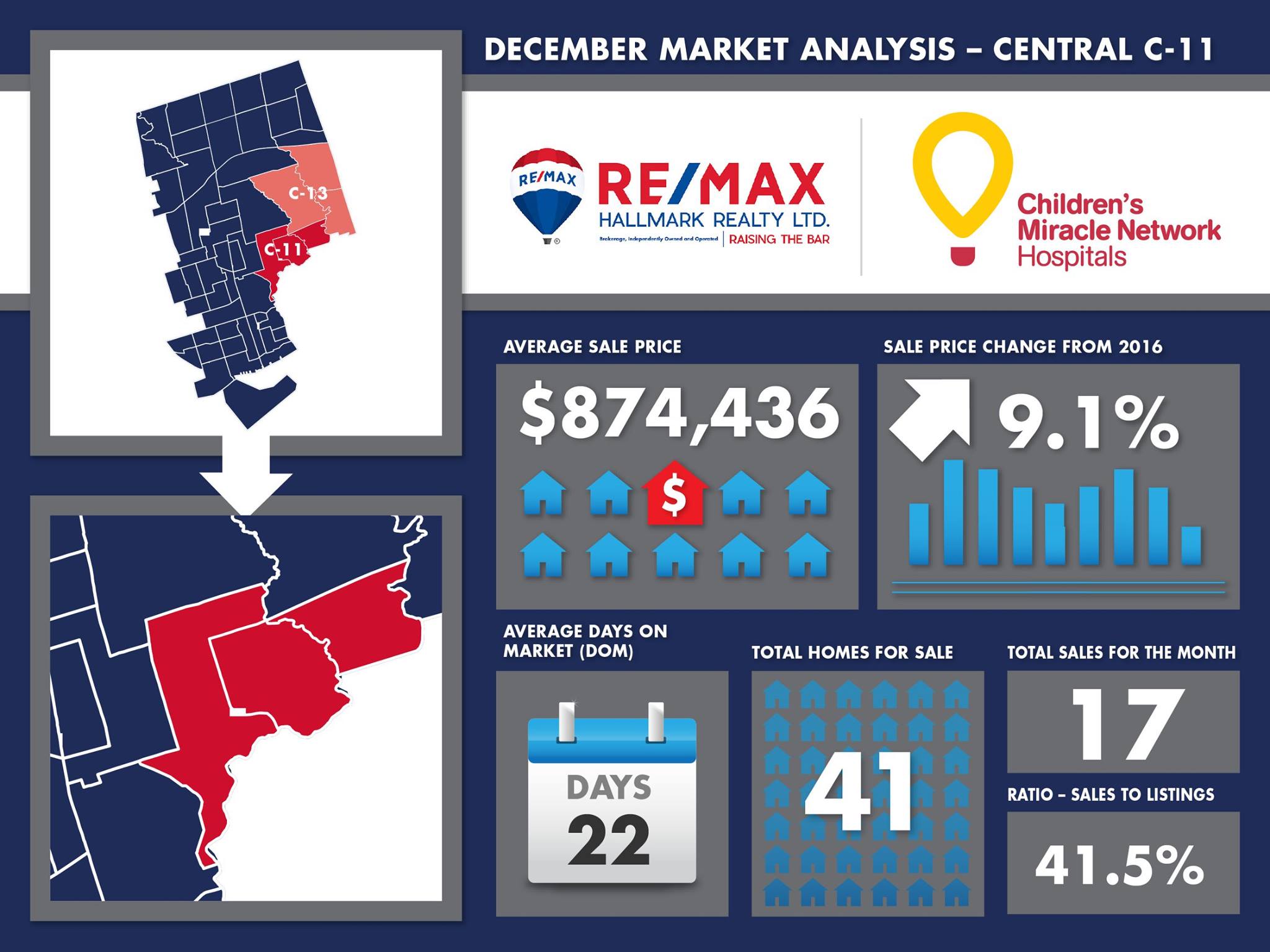

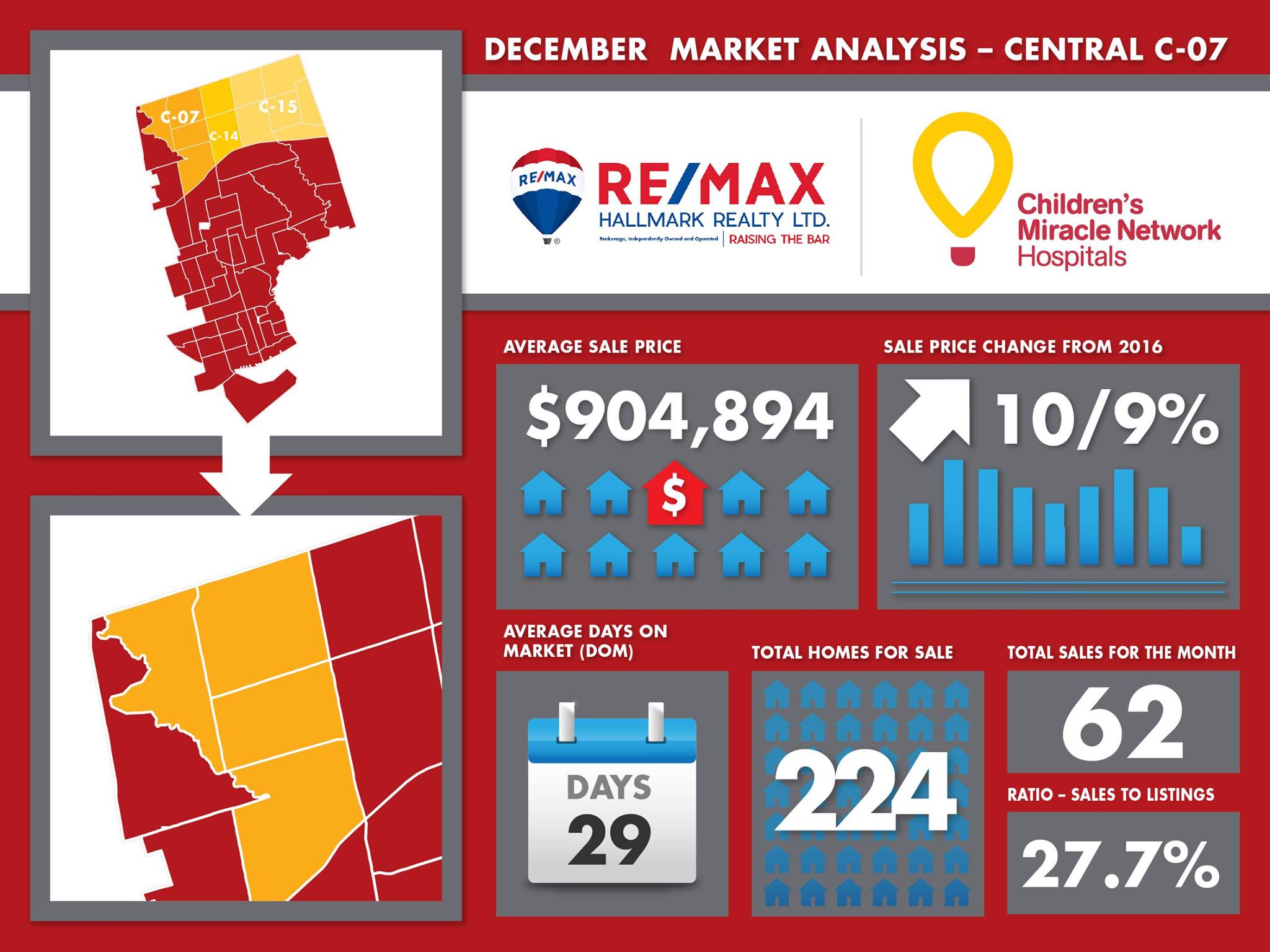

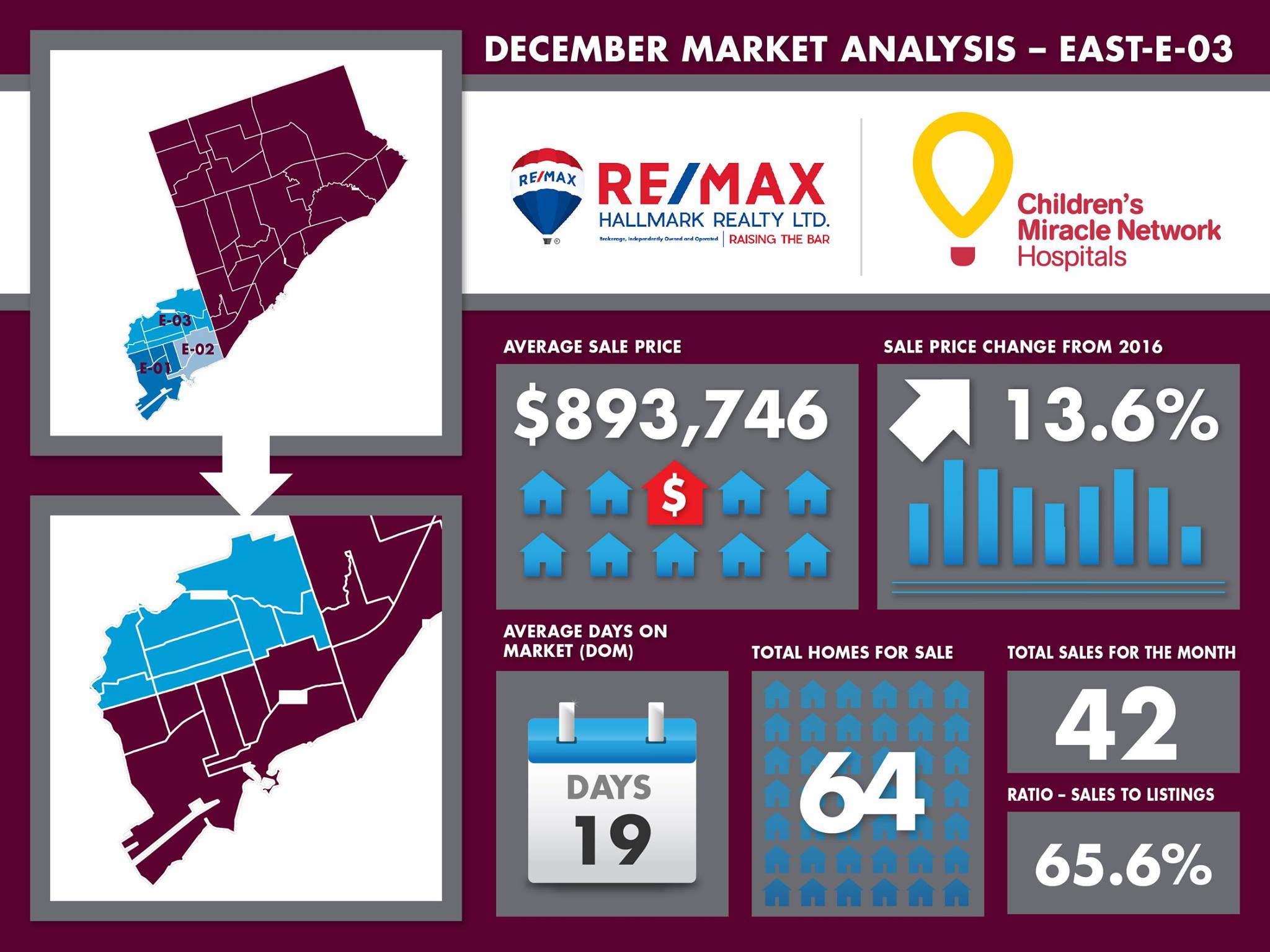

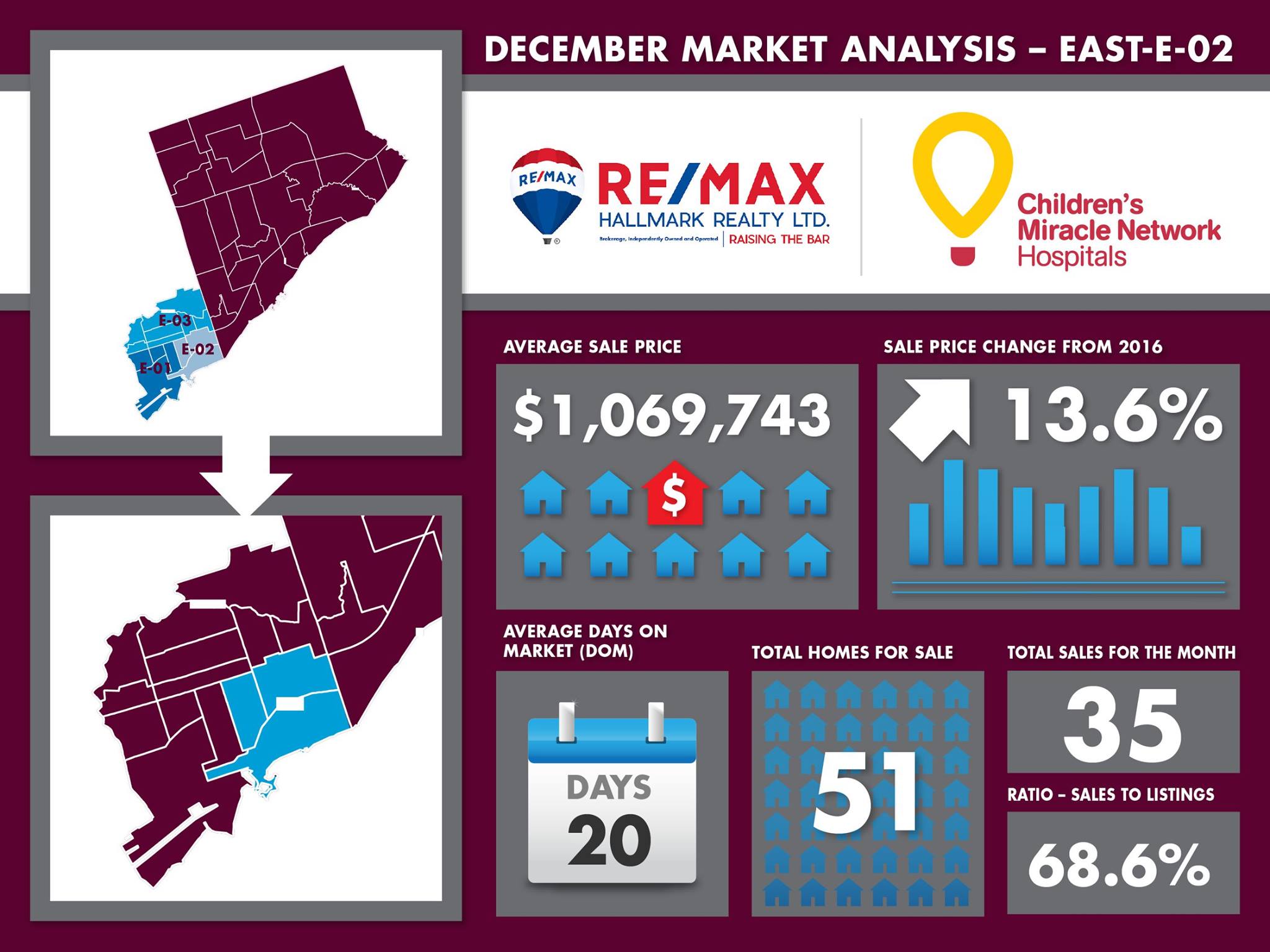

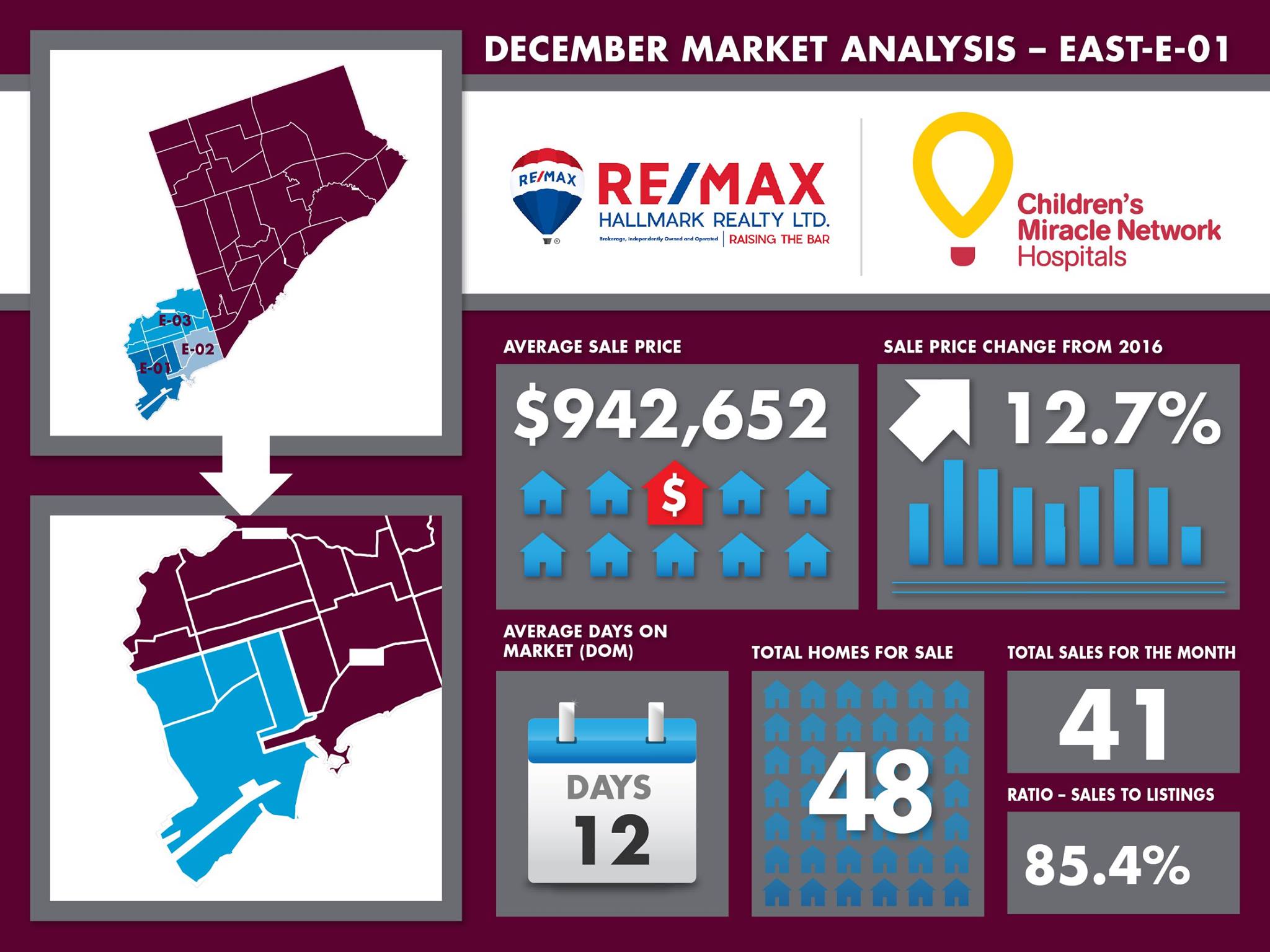

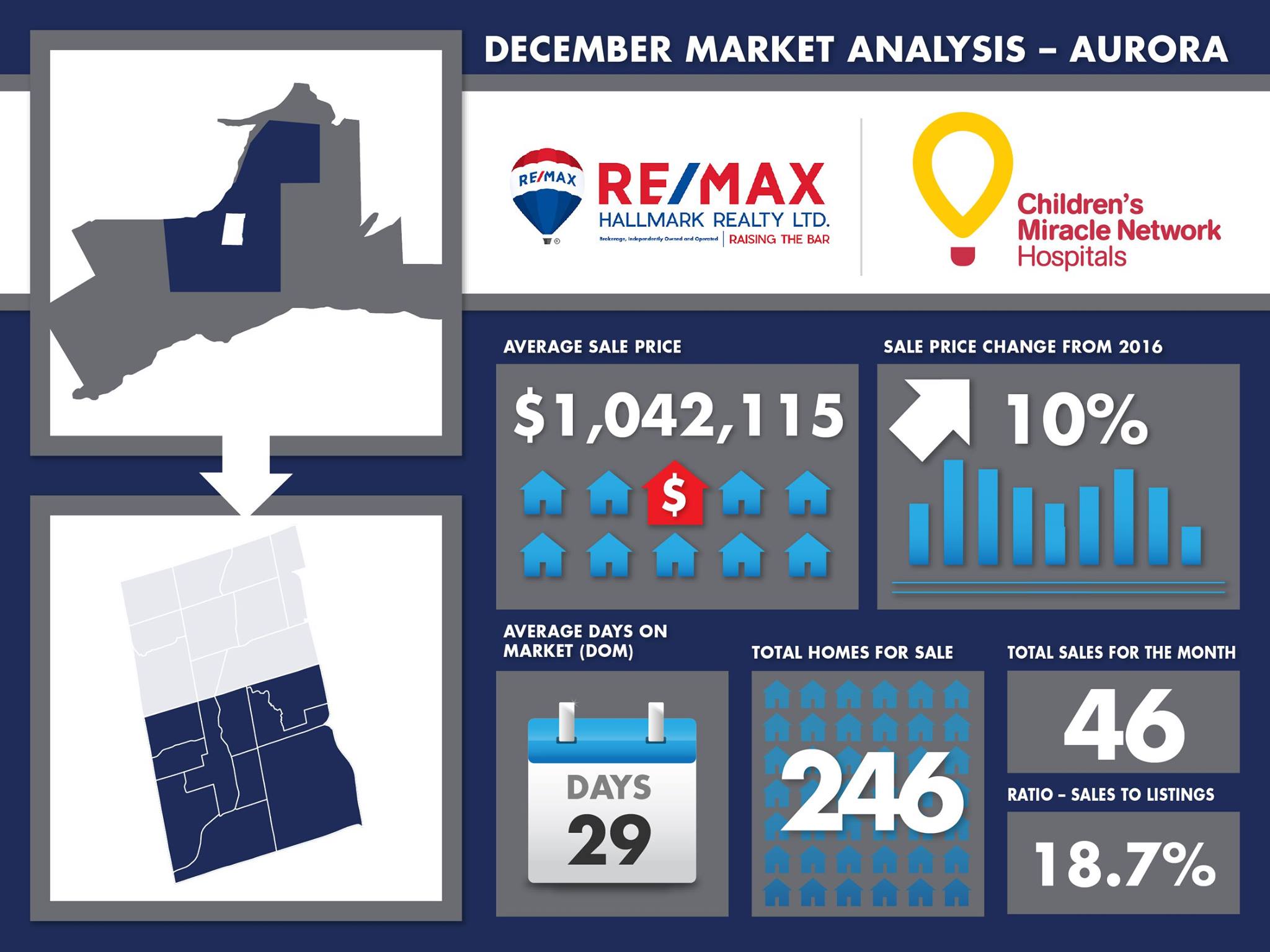

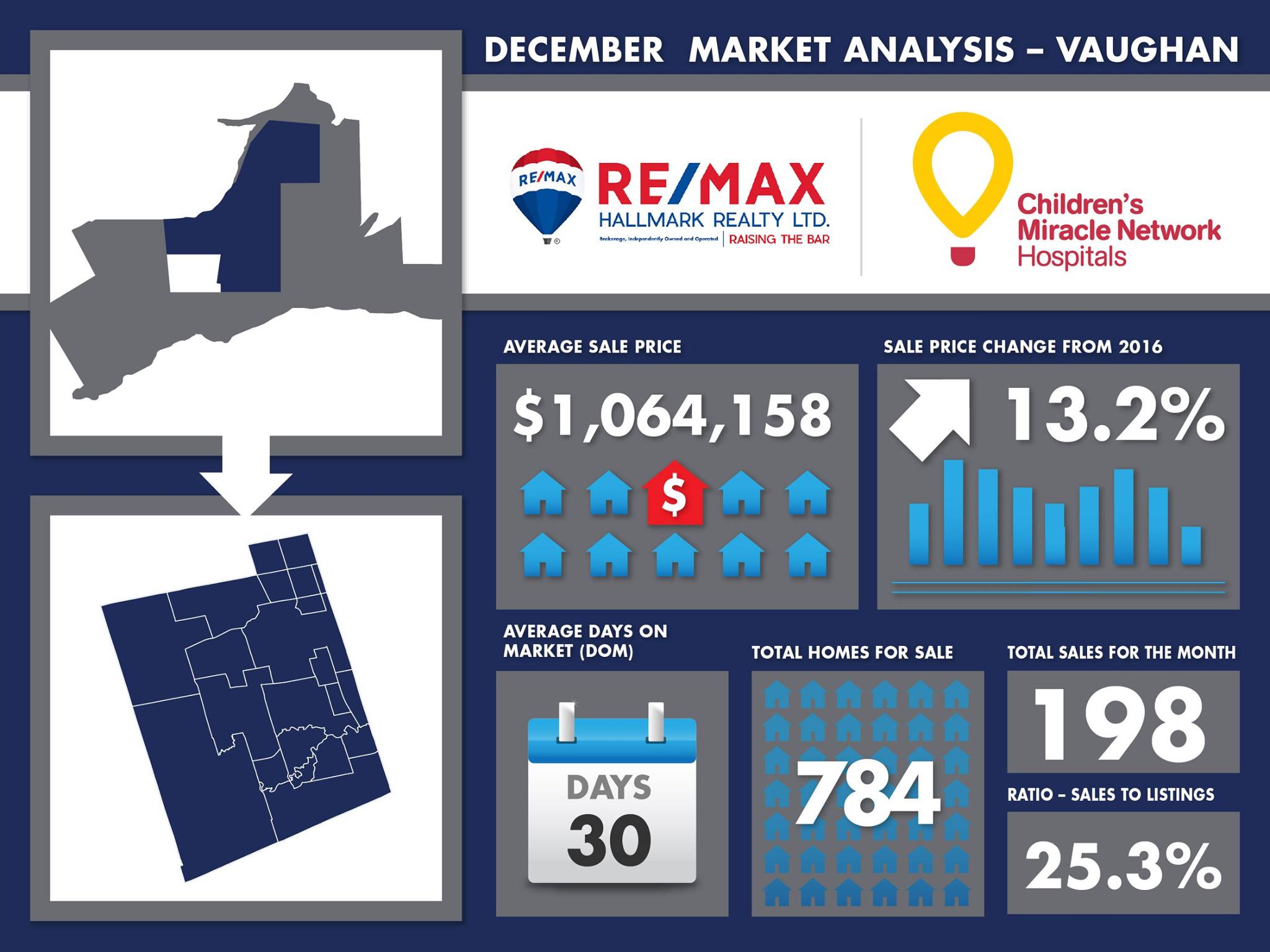

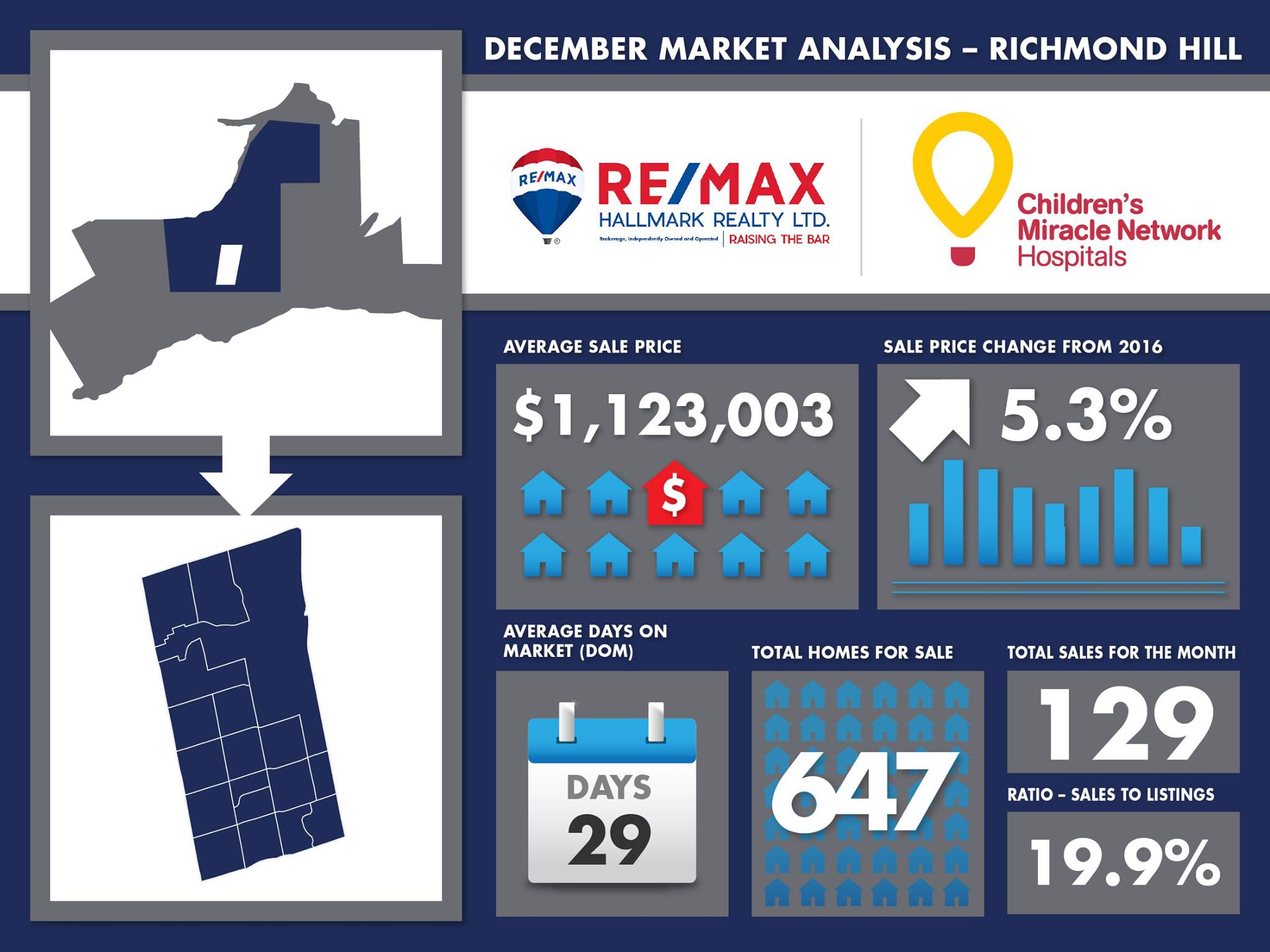

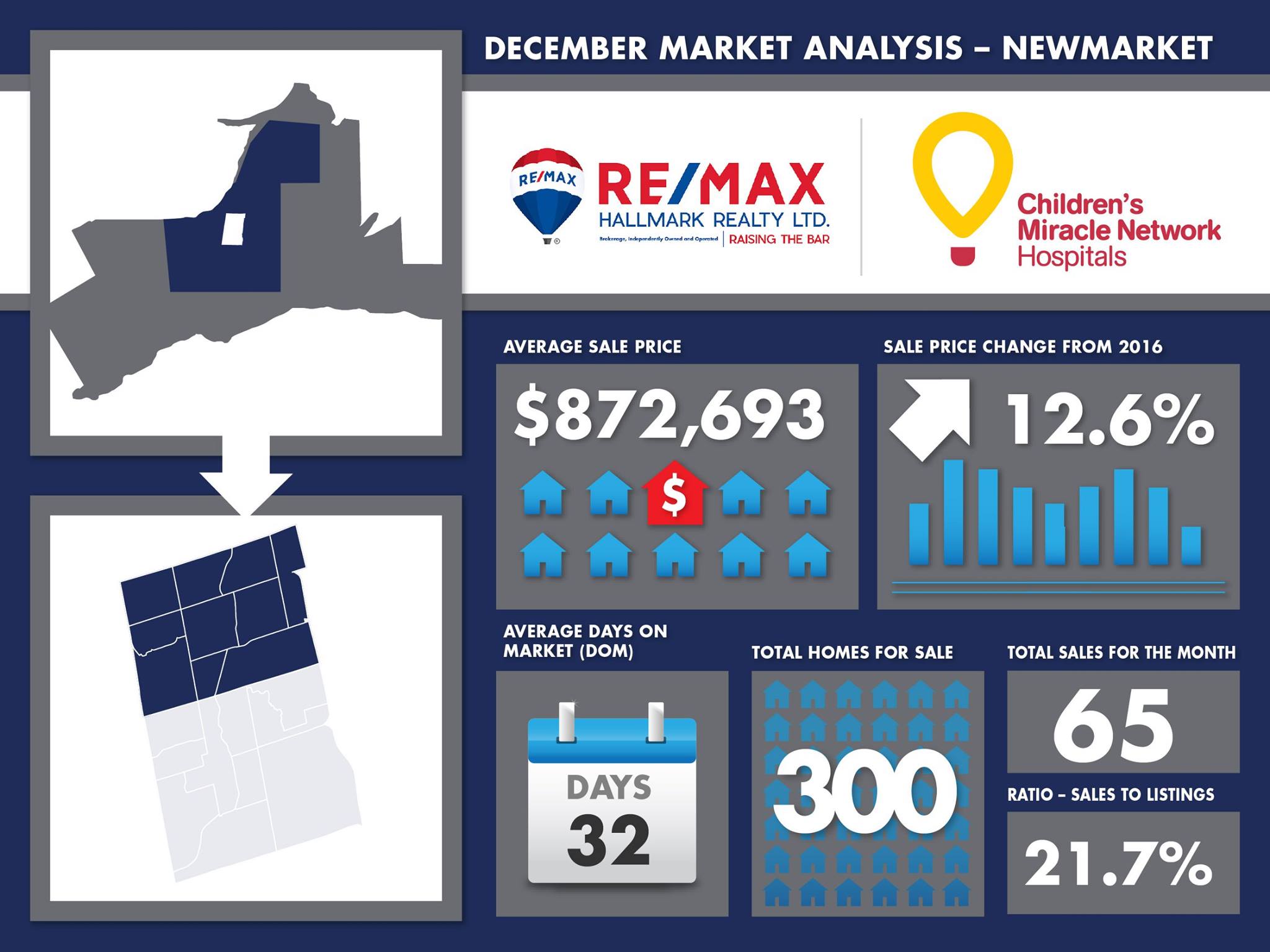

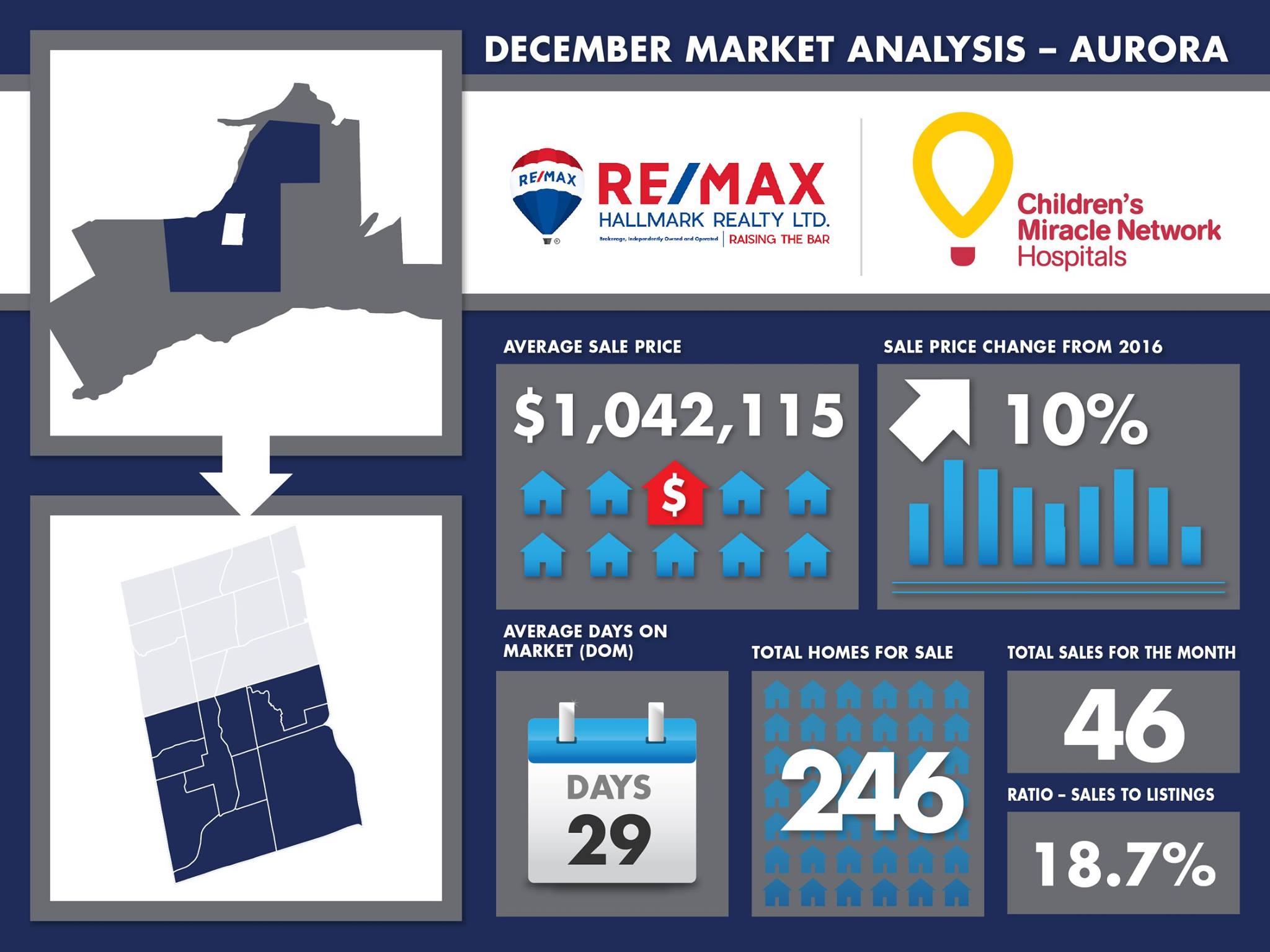

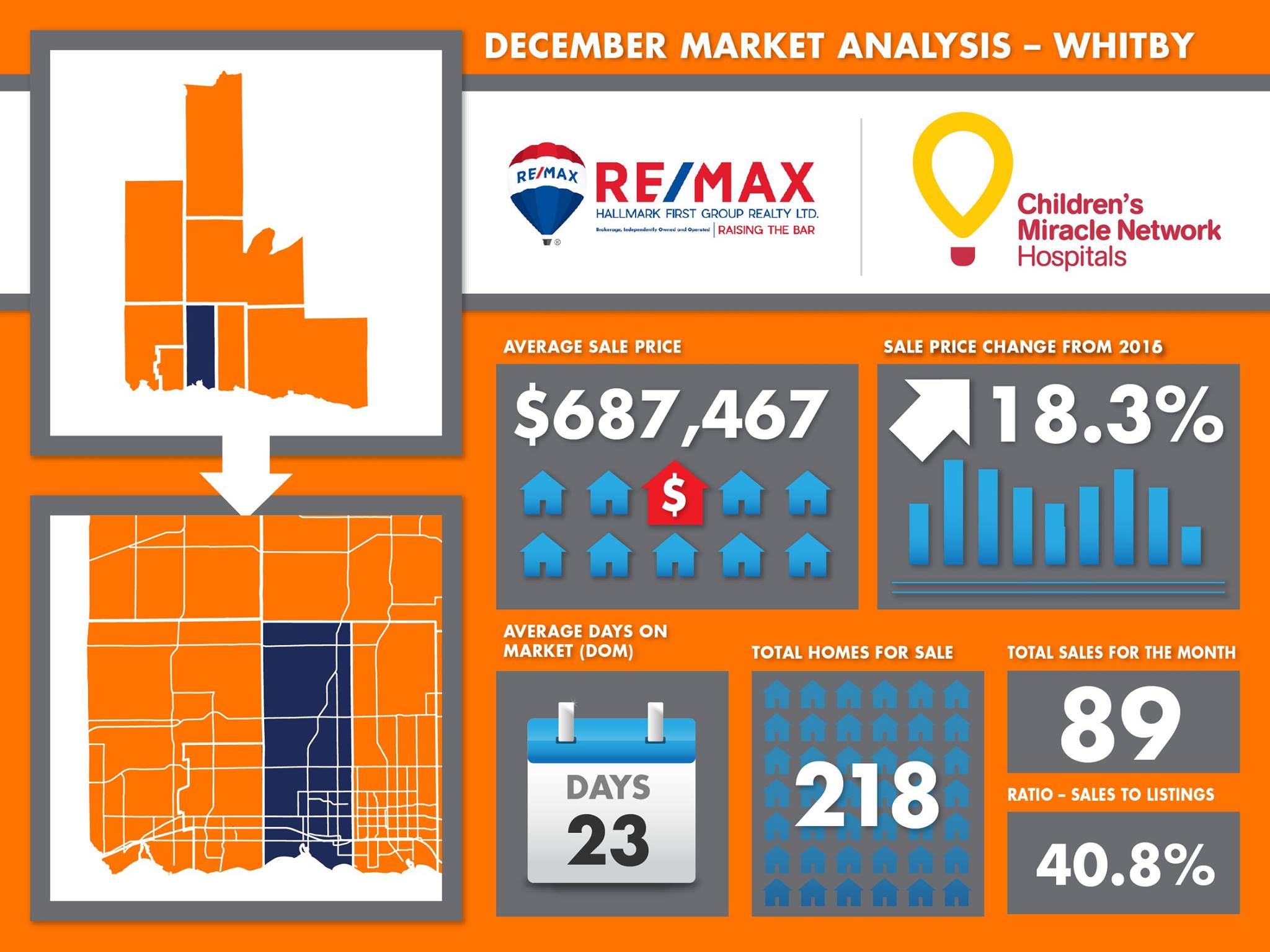

December Market Analysis

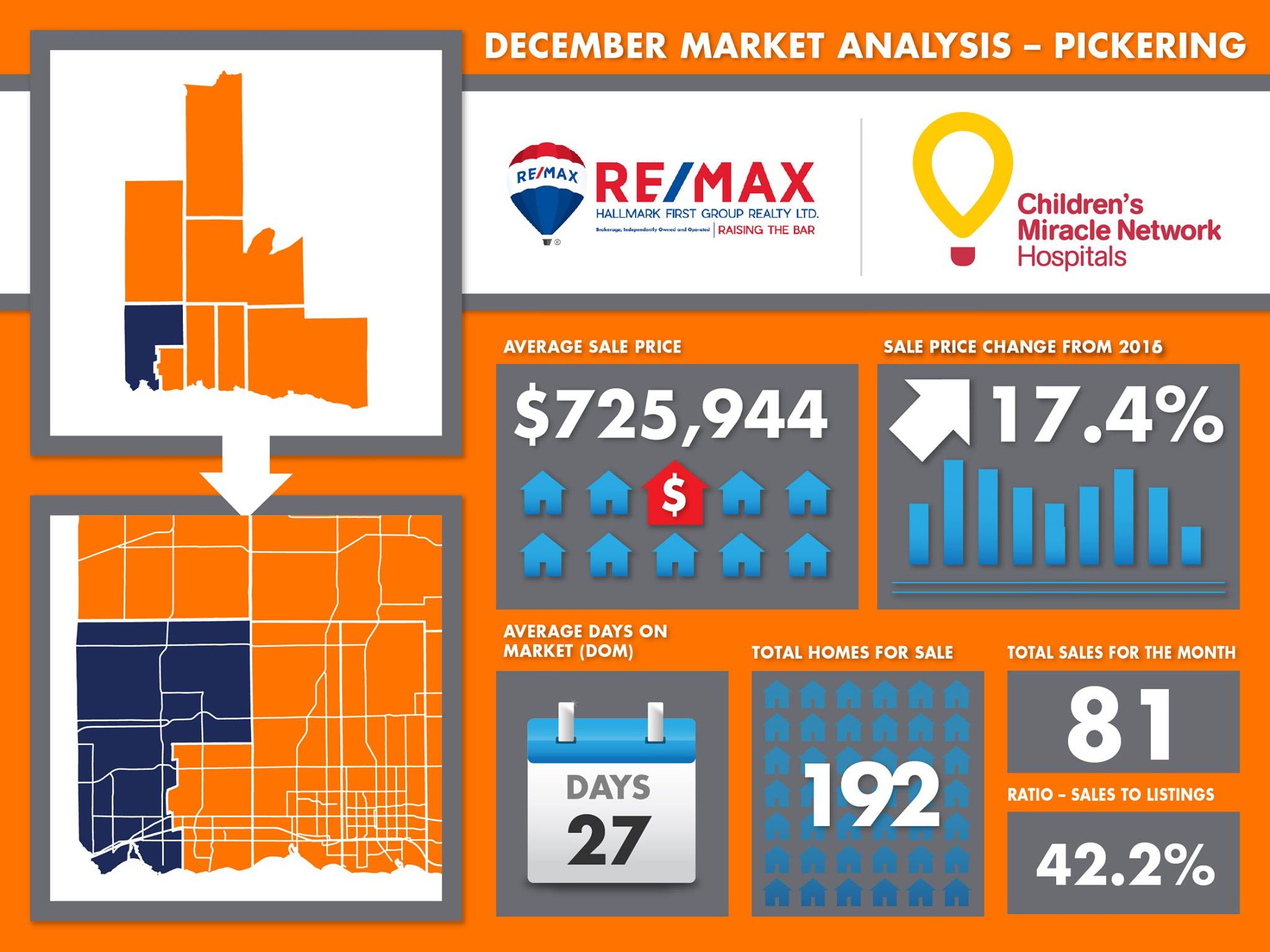

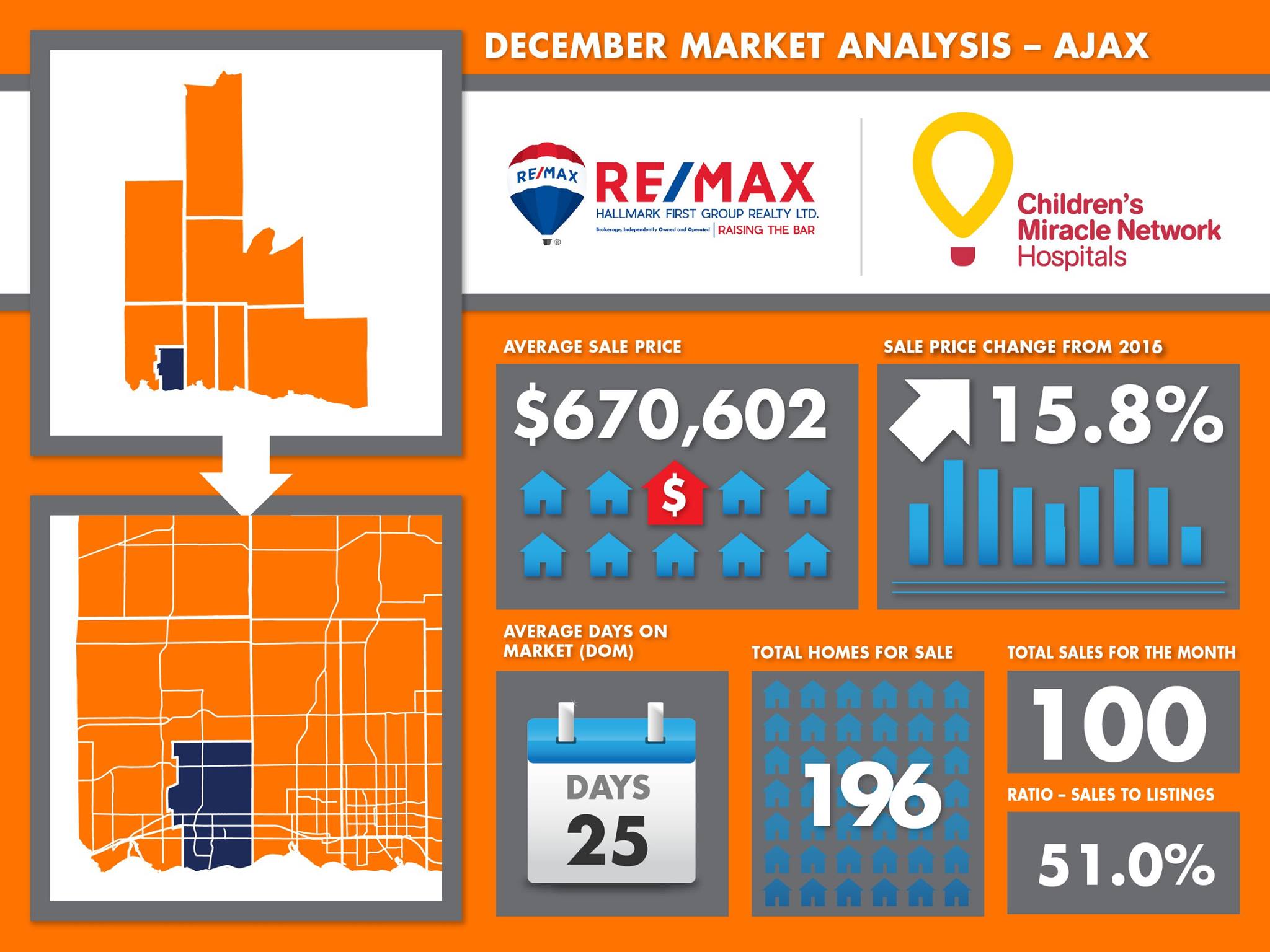

Here’s a summary of the significant real estate milestones and 'talking points' for December 2017.

Courtesy of Thomas Cook

* 4th highest number of overall sales for the month of December (4,930) and up by a few hundred homes from October

* 2017 had 92,394 total sales… a BIG drop from 113,000 last year and drops to 5th place in sales since 2012

* The ratio of sales-to-listings dropped back to 38.1% in December – a very moderate seller’s market

* The average sale price dropped slightly to $735,021 – BUT was flat compared to 2016 – because of higher sales of lower priced condos

* The final average for the entire 2017 year ended up at $822,681 – 12.7% higher than for 2016

* Sales in the month were down 7.1% from one year ago

* The GTA real estate market overall averaged the days-on-market at 27 – still quick compared to many markets

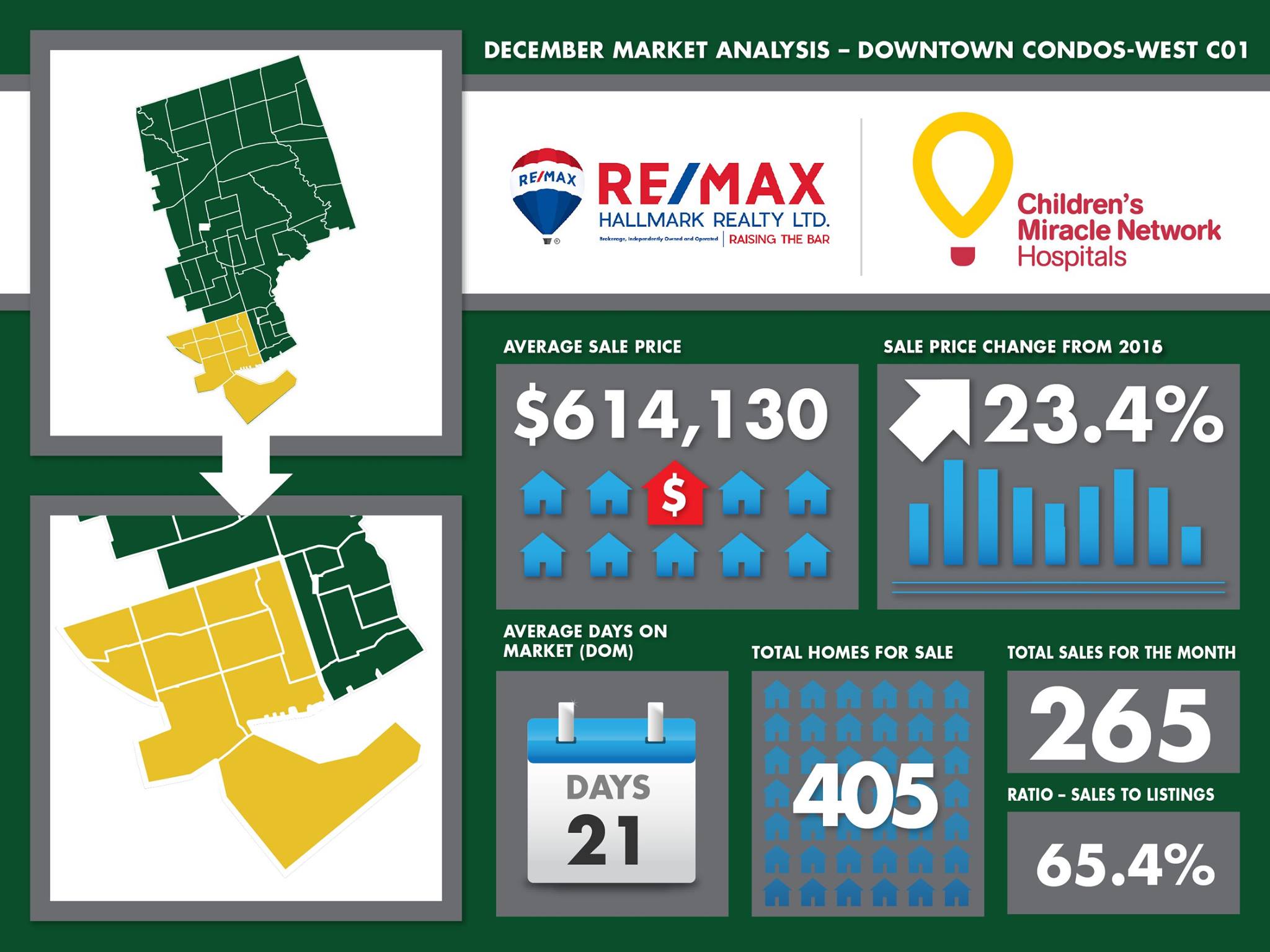

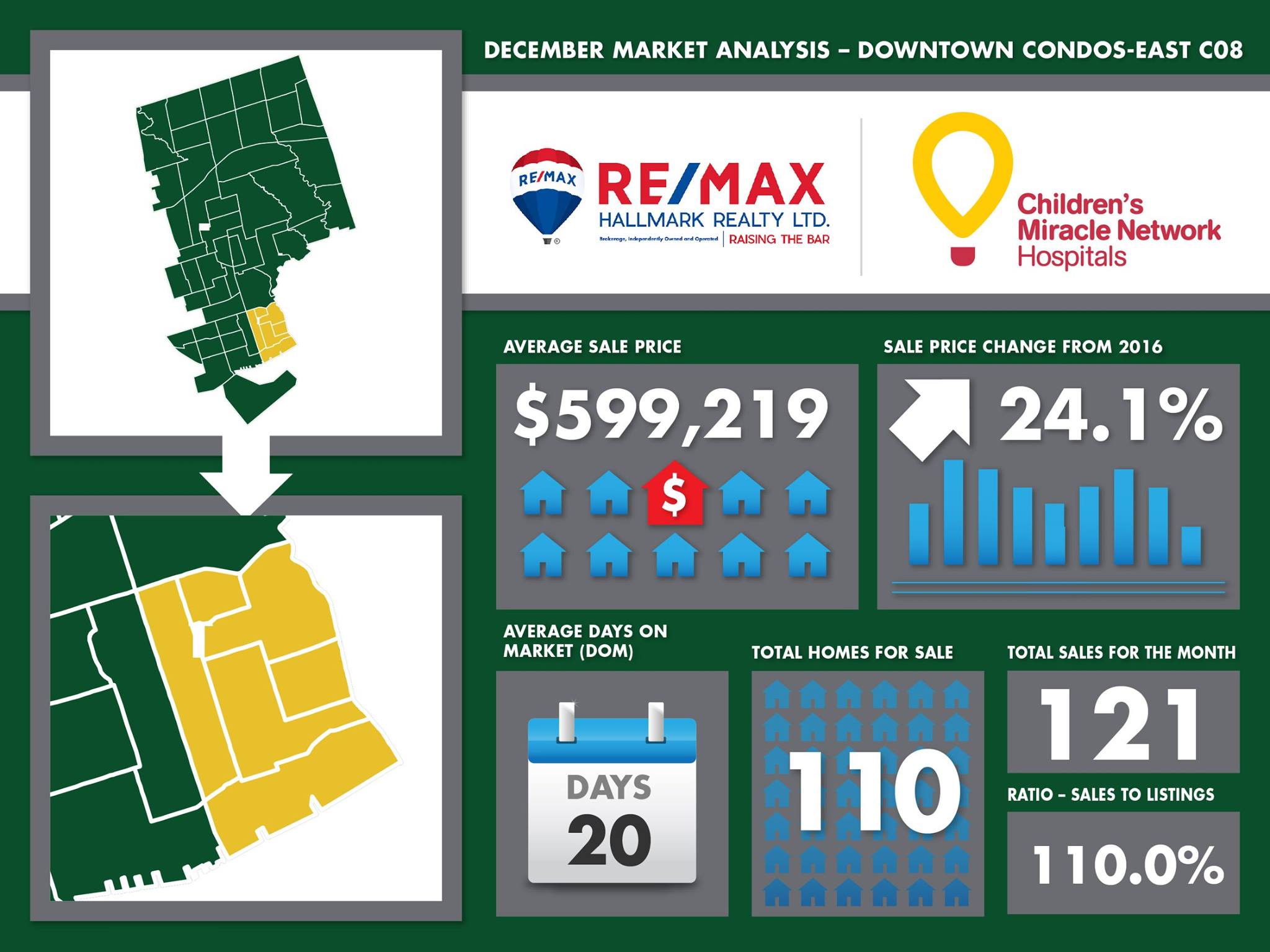

* Again, it’s becoming clear that first-time buyer aspirations are now shifting to a condominium lifestyle – CONDO sales took a ‘highest ever’ 40.3% of the total market in December… about 2-3% more than average

* Downtown condo listing numbers were up in C01 and down in C08 from last year at this time

* The downtown condo days-on-market average was 20-21 days – slightly faster than the overall market

* The ratio of sales-to-listings for condos downtown ranged between 65.4% in C01 to 110% in C08 indicating a very strong seller’s market… well ahead of most of the GTA

* The average sale price for downtown condominium suites is still up by roughly $120,000 from 2016

* Building on this higher demand due to better affordability, condo appreciation in the two main downtown markets averaged 24% year-over-year

* Markets in York Region and some other 905 neighbourhoods have suffered the most from the market slowdown – York Region is now showing that they’re in ‘buyer market’ territory

What do we have in common with New Edition and The Golden State Warriors?

We are hiring. We've announced to the world that we are looking to grow our team and our capacity. Its exciting and my vision is thoroughly different then some teams. Many teams in real estate are labelled after the team leader and the team leader is the alpha... with other realtors plugged into their respective roles. For example, Inside Sales Agent, prospecting and open house agent, buyer agent, etc.

This is like Diana Ross and the Supremes. Who can name the other member of the Surpremes? Not me without Google.

I want to be more like New Edition. New Edition was a pop icon group, but every member of New Edition was a superstar in their own right. Bobby Brown is MR RnB. Johnny Gill had vocals like no one else. Bel Biv Devoe has some of the most iconic songs of all time and Ralph Tresvant... well he was the most talented of them all.

No one member of New Edition couldn't stand on their own, and as a band... they were even bigger then all of them apart.

Another example... the Golden State Warriors. Let's face it... KD and Steph are both MVP worthy players. The whole team is mega talent, and they're a TEAM!

That's the idea behind Connexus. A group of individuals who are extremely talented pooling their resources to create an even better organization. Justin is an amazing agent. Driven, courteous, big thinking and highly knowledgable. Sarah is one of the most organized, detail oriented, resourceful agents out there. Myself... I've been an ambassador for my company and have been considered one of the best examples of high service agents in the industry. We are pooling our resources to create a platform for agents to have every possible advantage to be the best version of themselves in their career. AND have a lot of fun and help a lot of people.

Do you want to engage with us? Are you an agent who wants to be belly to belly with clients, building your circle and at the same time working on a team with the best administration, marketing, coaching, accountability and facilities possible?

Have you sold 10 properties on your own, and you've experienced the peaks and valleys of real estate? Do you go from very unbusy to being incapable of doing it all at the same time? Find your fit with us.

Send me a message and let's talk about whether you're ideal for Connexus.

416-992-2942

@ravisinghremax

@connexusgroup