The down payment rate was bound to change and that time is upon us. The days of 5% on a $1,000,000 home are behind us. Let's face it, we were running at high-risks with the old rates. The new down payment structure allows for more security for both buyers and sellers. Buyers won't feel overwhelmed with their mortgages and sellers will feel more secure in solidifying the deal. Not just that, but on the macro level, the market is further protected. The government of Canada wants Canadians to have equity in their homes and we couldn't agree more.

So what does this mean to you? Let's break it down.

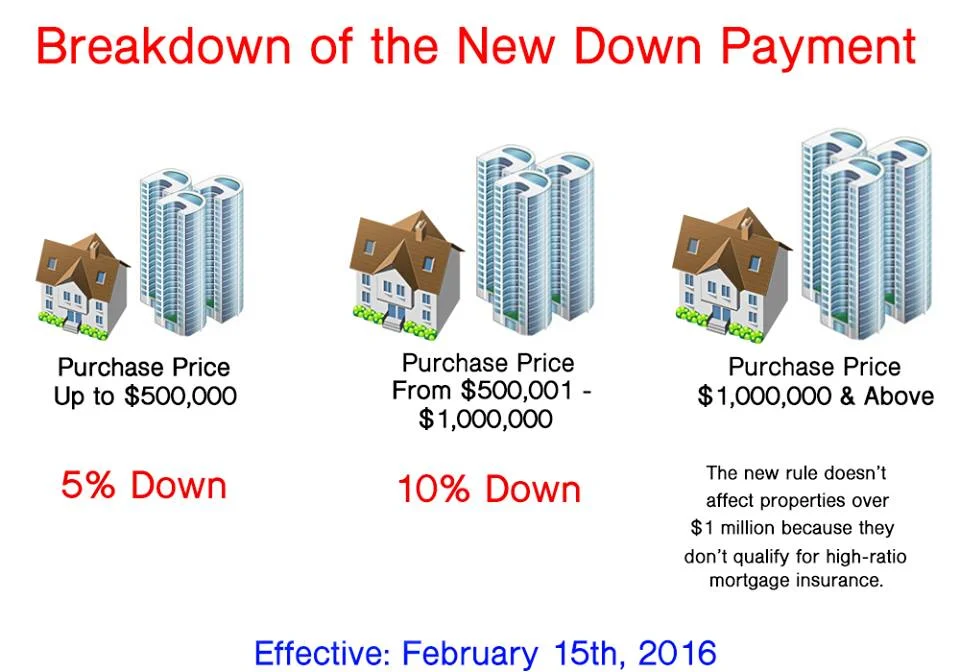

Any home with a purchase price of $500,000k or below can give a minimum of 5% for down payment.

A home between $500,001 - $1,000,000 will pay 10% down on the amount over $500,000.

The new rule doesn't affect properties over $1 million because they don't qualify for high-ratio mortgage insurance. They will need a 20% downpayment to qualify for a traditional mortgage.

These infographics simplify the change...