For immediate release

Intensification contributes to significant upswing in Toronto’s detached housing values

in the first six months of 2016, says RE/MAX Hallmark

Double-digit increases reported in close to 90 per cent of neighbourhoods

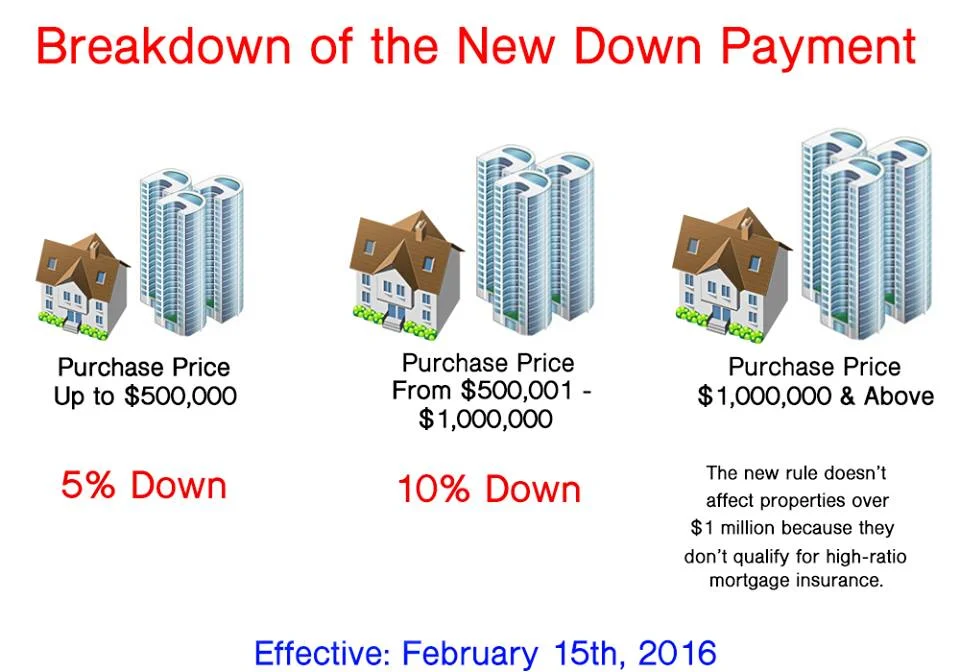

Toronto, ON (August 2, 2016) – Intensification within Toronto proper has served to further bolster price appreciation as builders and end users compete for a limited number of single-detached properties listed for sale, according to a report released today by RE/MAX Hallmark Realty Ltd. The overall average price of a detached home in the 416 area code is up 16.4 per cent in the first six months of 2016 to $1,230,340, compared to $1,056,688 during the same period one year ago.

“Average price will continue to soar in conjunction with improvements in housing stock,” says Ken McLachlan, Broker-Owner, RE/MAX Hallmark. “Teardown activity is rampant throughout Toronto and neighbouring Scarborough, as evidenced by the ever-increasing number of applications for zoning variances and lot severances. Scarcity of land, further exacerbated by the greenbelt to the north, east and west of the city, has also prompted double-digit increases of detached homes in 90 per cent of neighbourhoods in the 416 area code to date, with almost 57 per cent now reporting average prices in excess of $1 million. ”

RE/MAX Hallmark examined average price appreciation in four separate Toronto Real Estate Board districts (East, West, Central, York Region) and 44 communities for the first six months of 2016. Of the top five performing areas for detached homes in the 416 – in terms of price appreciation -- are all located in the central core. Banbury, Don Mills, Parkwoods, Donalda, and Victoria Village (C13) led the city with a 36.4 per cent increase in the average price of a detached home, with values rising from $1,335,548 to $1,821,777. Bayview Village, Bayview Woods-Steeles, Don Valley Village, Hillcrest Village, and Henry Farm (C15) ranked second with a 31.8 per cent upswing in the first six months of the year, with the price of an average detached home climbing to $1,649,510, up from $1,252,000 during the same period in 2015. Lansing, Westgate, Willowdale West, and Newtonbrook West (C07) experienced an uptick of just over 29 per cent, with average price rising from $1,257,458 to $1,624,017. The Bathurst Manor, Armour Heights communities (C06) rose 26.9 per cent year-to-date, with average price climbing from $1,010,711 to $1,282,135. Rounding out the top five was Willowdale East (C14) with a 26.4 per cent increase in detached housing values ($1,596,358 to $2,018,060).

“As pricing for detached housing south of Highway 401 escalates, buyers have set their sights on communities north of the 401 that offer up bungalows and smaller two-storey homes on good size lots at more affordable price points,” explains McLachlan. “However, fewer and fewer post-war homes are available within Toronto proper, given the move toward re-gentrification.”

Detached housing values north of Steeles Ave. in York Region have spiked as a result of the ripple effect, according to McLachlan. Both Aurora and King experienced strong upward pressure on prices (28.6 per cent and 27.7 per cent respectively) in the first six months of 2016, but so too have other communities including Georgina (26.2 per cent), Newmarket (25 per cent), Richmond Hill (24.7 per cent), and Markham (24.4 per cent).

More than 7,000 detached homes changed hands in York Region between January 1 and June 30, an increase of almost 14 per cent over the 6,310 sales reported during the same period in 2015. Limited inventory levels kept detached sales increases to half a percentage point in the central core (2,263 vs. 2,252), three per cent in the west end (2,130 vs. 2,068), and close to six per cent in the east (2,490 vs. 2,358), with the vast majority of gains occurring in Scarborough.

RE/MAX Hallmark Realty Ltd. is one of the largest real estate franchises in Ontario, with more than 1,100 sales associates operating out of 14 offices throughout the Greater Toronto Area, Ottawa, and the Muskoka Region. The team specializes in all aspects of real estate, including residential, recreational and commercial properties. RE/MAX Hallmark is firmly entrenched in the communities it serves through its involvement in Children’s Miracle Network and grassroots fundraising initiatives. Visit the RE/MAX Hallmark website at: www.torontohomesandcondos.com